Analysis of Form 144 Restricted Sales Notifications

This notebook demonstrates an exploratory data analysis examining notifications of restricted and control securities filed under SEC Rule 144 in SEC Form 144.

Since 2022, companies are required to file this form in XML format. Leveraging our Form 144 - Restricted Sales Notification API, we transform these disclosures into a standardized JSON format, facilitating comprehensive and efficient analysis.

Our analysis addresses several critical dimensions:

- Temporal trends in the number of Restricted Sales Notifications from 2022 to 2024, segmented by quarter, month, and intraday timing (pre-market, regular market hours, after-market).

- Distribution patterns across structured data fields, including the proportion of disclosures categorized by specific form types.

- Analysis of the proposed sales volume, including their distribution and temporal evolution.

- Timing of notification of sales

- Time between acquisition and sale

Quick Start

To quickly retrieve data for a specific company, modify the following example as needed. For more detail, see Form 144 - Restricted Sales Notification API and sec-api-python package readme.

%pip install sec_api # use %pip for reliable install in current environment

# NOTE: Replace with your own API key

API_KEY_SEC_API = "YOUR_API_KEY"

from sec_api import Form144Api

import json

searchApi = Form144Api(api_key=API_KEY_SEC_API)

search_params = {

"query": "issuerInfo.issuerCik:7431",

"from": "0",

"size": "1",

"sort": [{"filedAt": {"order": "desc"}}],

}

# get proposed sales information, sales history, and other details

response = searchApi.get_data(search_params)

filing = response["data"]

print(json.dumps(filing, indent=2))

{

"id": "a19d6a8949fb7292ed2acfbef53c2605",

"accessionNo": "0001950047-24-005841",

"fileNo": "001-02116",

"formType": "144",

"filedAt": "2024-08-06T16:19:52-04:00",

"entities": [

{

"fiscalYearEnd": "1231",

"stateOfIncorporation": "PA",

"act": "33",

"cik": "7431",

"fileNo": "001-02116",

"irsNo": "230366390",

"companyName": "ARMSTRONG WORLD INDUSTRIES INC (Subject)",

"type": "144",

"sic": "3089 Plastics Products, NEC",

"filmNo": "241179595",

"undefined": "08 Industrial Applications and Services)"

},

{

"cik": "1471798",

"companyName": "Melville James Clinton (Reporting)",

"type": "144"

}

],

"issuerInfo": {

"issuerCik": "7431",

"issuerName": "ARMSTRONG WORLD INDUSTRIES INC.",

"secFileNumber": "001-02116",

"issuerAddress": {

"street1": "2500 Columbia Avenue",

"city": "Lancaster",

"stateOrCountry": "PA",

"zipCode": "17603"

},

"issuerContactPhone": "(717) 397-0611",

"nameOfPersonForWhoseAccountTheSecuritiesAreToBeSold": "JAMES C MELVILLE",

"relationshipsToIssuer": "Director",

"issuerTicker": "AWI"

},

"securitiesInformation": [

{

"securitiesClassTitle": "Common",

"brokerOrMarketmakerDetails": {

"name": "Morgan Stanley Smith Barney LLC Executive Financial Services",

"address": {

"street1": "1 New York Plaza",

"street2": "8th Floor",

"city": "New York",

"stateOrCountry": "NY",

"zipCode": "10004"

}

},

"noOfUnitsSold": 10332,

"aggregateMarketValue": 1265774.52,

"noOfUnitsOutstanding": 43700062,

"approxSaleDate": "08/06/2024",

"securitiesExchangeName": "NYSE"

}

],

"securitiesToBeSold": [

{

"securitiesClassTitle": "Common",

"acquiredDate": "07/14/2017",

"natureOfAcquisitionTransaction": "Restricted stock vesting under a registered plan",

"nameOfPersonfromWhomAcquired": "Issuer",

"isGiftTransaction": false,

"amountOfSecuritiesAcquired": 2298,

"paymentDate": "07/14/2017",

"natureOfPayment": "Services Rendered"

},

{

"securitiesClassTitle": "Common",

"acquiredDate": "01/03/2011",

"natureOfAcquisitionTransaction": "Restricted stock vesting under a registered plan",

"nameOfPersonfromWhomAcquired": "Issuer",

"isGiftTransaction": false,

"amountOfSecuritiesAcquired": 2204,

"paymentDate": "01/03/2011",

"natureOfPayment": "Services Rendered"

},

{

"securitiesClassTitle": "Common",

"acquiredDate": "06/24/2013",

"natureOfAcquisitionTransaction": "Restricted stock vesting under a registered plan",

"nameOfPersonfromWhomAcquired": "Issuer",

"isGiftTransaction": false,

"amountOfSecuritiesAcquired": 1021,

"paymentDate": "06/24/2013",

"natureOfPayment": "Services Rendered"

},

{

"securitiesClassTitle": "Common",

"acquiredDate": "07/13/2015",

"natureOfAcquisitionTransaction": "Restricted stock vesting under a registered plan",

"nameOfPersonfromWhomAcquired": "Issuer",

"isGiftTransaction": false,

"amountOfSecuritiesAcquired": 2197,

"paymentDate": "07/13/2015",

"natureOfPayment": "Services Rendered"

},

{

"securitiesClassTitle": "Common",

"acquiredDate": "07/11/2016",

"natureOfAcquisitionTransaction": "Restricted stock vesting under a registered plan",

"nameOfPersonfromWhomAcquired": "Issuer",

"isGiftTransaction": false,

"amountOfSecuritiesAcquired": 2612,

"paymentDate": "07/11/2016",

"natureOfPayment": "Services Rendered"

}

],

"nothingToReportFlagOnSecuritiesSoldInPast3Months": false,

"securitiesSoldInPast3Months": [

{

"sellerDetails": {

"name": "JAMES C MELVILLE",

"address": {

"street1": "2500 Columbia Avenue",

"city": "Lancaster",

"stateOrCountry": "PA",

"zipCode": "17603"

}

},

"securitiesClassTitle": "Common",

"saleDate": "08/05/2024",

"amountOfSecuritiesSold": 1000,

"grossProceeds": 120432.5

},

{

"sellerDetails": {

"name": "JAMES C MELVILLE",

"address": {

"street1": "2500 Columbia Avenue",

"city": "Lancaster",

"stateOrCountry": "PA",

"zipCode": "17603"

}

},

"securitiesClassTitle": "Common",

"saleDate": "08/05/2024",

"amountOfSecuritiesSold": 1000,

"grossProceeds": 119493.1

},

{

"sellerDetails": {

"name": "JAMES C MELVILLE",

"address": {

"street1": "2500 Columbia Avenue",

"city": "Lancaster",

"stateOrCountry": "PA",

"zipCode": "17603"

}

},

"securitiesClassTitle": "Common",

"saleDate": "08/05/2024",

"amountOfSecuritiesSold": 3405,

"grossProceeds": 417867.39

},

{

"sellerDetails": {

"name": "JAMES C MELVILLE",

"address": {

"street1": "2500 Columbia Avenue",

"city": "Lancaster",

"stateOrCountry": "PA",

"zipCode": "17603"

}

},

"securitiesClassTitle": "Common",

"saleDate": "08/02/2024",

"amountOfSecuritiesSold": 5000,

"grossProceeds": 633344

},

{

"sellerDetails": {

"name": "JAMES C MELVILLE",

"address": {

"street1": "2500 Columbia Avenue",

"city": "Lancaster",

"stateOrCountry": "PA",

"zipCode": "17603"

}

},

"securitiesClassTitle": "Common",

"saleDate": "08/02/2024",

"amountOfSecuritiesSold": 5000,

"grossProceeds": 626731

}

],

"noticeSignature": {

"noticeDate": "08/06/2024",

"signature": "/s/ James C. Melville"

}

}

Download Dataset

To load and prepare the dataset of over 70,000 offering statement filings from Forms 144 in since October 2022, we utilize the Form 144 - Restricted Sales Notification API. The following code handles data loading and preparation by executing multiple download processes in parallel, significantly reducing downloading time.

Once downloaded, all data objects are saved in JSONL format to ./form-144-dataset.jsonl.gz.

Downloading the data may take several minutes.

import sys

import os

import time

import random

# from multiprocessing import Pool # use in .py files only

from concurrent.futures import ThreadPoolExecutor

YEARS = range(2025, 2021, -1) # from 2025 to 2022

TEMP_FILE_TEMPLATE = "./temp_file_form_144_{}.jsonl"

TARGET_FILE = "./form-144-dataset.jsonl.gz"

def process_year(year):

backoff_time = random.randint(10, 800) / 1000

print(f"Starting year {year} with backoff time {backoff_time:,}s")

sys.stdout.flush()

time.sleep(backoff_time)

tmp_filename = TEMP_FILE_TEMPLATE.format(year)

tmp_file = open(tmp_filename, "a")

for month in range(12, 0, -1):

search_from = 0

month_counter = 0

while True:

query = f"filedAt:[{year}-{month:02d}-01 TO {year}-{month:02d}-31]"

searchRequest = {

"query": query,

"from": search_from,

"size": "50",

"sort": [{"filedAt": {"order": "desc"}}],

}

response = None

try:

response = Form144Api.get_data(searchRequest)

except Exception as e:

print(f"{year}-{month:02d} error: {e}")

sys.stdout.flush()

continue

if response == None or len(response["data"]) == 0:

break

search_from += 50

month_counter += len(response["data"])

jsonl_data = "\n".join([json.dumps(entry) for entry in response["data"]])

tmp_file.write(jsonl_data + "\n")

print(f"Finished loading {month_counter} filings for {year}-{month:02d}")

sys.stdout.flush()

tmp_file.close()

return year

if not os.path.exists(TARGET_FILE):

with ThreadPoolExecutor(max_workers=4) as pool:

processed_years = list(pool.map(process_year, YEARS))

print("Finished processing all years.", processed_years)

import gzip

# Merge the temporary files into one final compressed file

with gzip.open(TARGET_FILE, "wt", encoding="utf-8") as outfile:

for year in YEARS:

temp_file = TEMP_FILE_TEMPLATE.format(year)

if os.path.exists(temp_file):

with open(temp_file, "r", encoding="utf-8") as infile:

for line in infile:

outfile.write(line) # Preserve JSONL format

else:

print("File already exists. Skipping download.")

File already exists. Skipping download.

# install all dependencies required for the notebook

# %pip install pandas numpy matplotlib seaborn

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import matplotlib.style as style

import matplotlib.ticker as mtick

import seaborn as sns

style.use("default")

params = {

"axes.labelsize": 8,

"font.size": 8,

"legend.fontsize": 8,

"xtick.labelsize": 8,

"ytick.labelsize": 8,

"font.family": "sans-serif",

"axes.spines.top": False,

"axes.spines.right": False,

"grid.color": "grey",

"axes.grid": True,

"axes.grid.axis": "y",

"grid.alpha": 0.5,

"grid.linestyle": ":",

}

plt.rcParams.update(params)

form_name = "Form 144"

form_name_escaped = "form-144"

structured_data = pd.read_json(TARGET_FILE, lines=True)

structured_data = pd.json_normalize(structured_data.to_dict(orient="records"))

structured_data["filedAt"] = pd.to_datetime(structured_data["filedAt"], utc=True)

structured_data["filedAt"] = structured_data["filedAt"].dt.tz_convert("US/Eastern")

structured_data = structured_data.sort_values("filedAt", ascending=True).reset_index(

drop=True

)

# there are two filings per accession number for Form 144

# if you want to access individual company information, comment out the following line

# structured_data.drop_duplicates("accessionNo", keep="first", inplace=True)

structured_data["year"] = structured_data["filedAt"].dt.year

structured_data["month"] = structured_data["filedAt"].dt.month

structured_data["qtr"] = structured_data["month"].apply(lambda x: (x - 1) // 3 + 1)

structured_data["dayOfWeek"] = structured_data["filedAt"].dt.day_name()

# filedAtClass: preMarket (4:00AM-9:30AM), regularMarket (9:30AM-4:00PM), afterMarket (4:00PM-8:00PM)

structured_data["filedAtClass"] = structured_data["filedAt"].apply(

lambda x: (

"preMarket"

if x.hour < 9 or (x.hour == 9 and x.minute < 30)

else (

"regularMarket"

if x.hour < 16

else "afterMarket" if x.hour < 20 else "other"

)

)

)

structured_data.head()

| id | accessionNo | fileNo | formType | filedAt | entities | securitiesInformation | securitiesToBeSold | nothingToReportFlagOnSecuritiesSoldInPast3Months | securitiesSoldInPast3Months | ... | issuerInfo.issuerTicker | noticeSignature.noticeDate | noticeSignature.signature | noticeSignature.planAdoptionDates | issuerInfo.issuerAddress.street2 | year | month | qtr | dayOfWeek | filedAtClass | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | f2ce9febeff7a9b6e879a4363b739587 | 0001921094-22-000004 | 001-15525 | 144 | 2022-10-07 14:02:22-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'HUIMIN WANG', 'ad... | ... | EW | 10/07/2022 | HUIMIN WANG | [02/04/2022] | NaN | 2022 | 10 | 4 | Friday | regularMarket |

| 1 | 567dd75f17174c76d37f00bedfa4c735 | 0000107476-22-000007 | 000-54296 | 144 | 2022-10-07 15:28:02-04:00 | [{'fiscalYearEnd': '0630', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | True | NaN | ... | AXIM | 10/06/2022 | Blake N Schroeder | [09/21/2022] | SUITE 114 | 2022 | 10 | 4 | Friday | regularMarket |

| 2 | 7ef0c9ab185899ca8a1d41d6f920638c | 0001921094-22-000006 | 001-37824 | 144 | 2022-10-13 15:33:54-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'CARY BAKER', 'add... | ... | PI | 10/13/2022 | CARY BAKER | NaN | SUITE 1200 | 2022 | 10 | 4 | Thursday | regularMarket |

| 3 | 3ad3feb808dea5da2ee6c92173f4caf2 | 0001921094-22-000008 | 001-37824 | 144 | 2022-10-13 15:42:36-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'CHRIS DIORIO', 'a... | ... | PI | 10/13/2022 | CHRIS DIORIO | NaN | SUITE 1200 | 2022 | 10 | 4 | Thursday | regularMarket |

| 4 | f86981868a5c6b61555386db9ff54aa6 | 0001921094-22-000010 | 001-37824 | 144 | 2022-10-13 15:47:35-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'JEFF DOSSETT', 'a... | ... | PI | 10/13/2022 | JEFF DOSSETT | NaN | SUITE 1200 | 2022 | 10 | 4 | Thursday | regularMarket |

5 rows × 32 columns

accNoToInsiderAndIssuer = {}

for idx, row in structured_data.iterrows():

accNo = row["accessionNo"]

entities = row["entities"]

issuerCik = row["issuerInfo.issuerCik"]

issuerName = row["issuerInfo.issuerName"]

accNoToInsiderAndIssuer[accNo] = {}

for entity in entities:

if entity["cik"] == issuerCik:

accNoToInsiderAndIssuer[accNo].update(

{

"issuerName": entity["companyName"],

"issuerCik": entity["cik"],

}

)

else:

accNoToInsiderAndIssuer[accNo].update(

{

"insiderName": entity["companyName"],

"insiderCik": entity["cik"],

}

)

structured_data["issuerCik"] = structured_data["accessionNo"].apply(

lambda x: accNoToInsiderAndIssuer[x]["issuerCik"]

)

structured_data["issuerName"] = structured_data["accessionNo"].apply(

lambda x: accNoToInsiderAndIssuer[x]["issuerName"]

)

structured_data["insiderCik"] = structured_data["accessionNo"].apply(

lambda x: accNoToInsiderAndIssuer.get(x, {}).get("insiderCik", np.nan)

)

structured_data["insiderName"] = structured_data["accessionNo"].apply(

lambda x: accNoToInsiderAndIssuer.get(x, {}).get("insiderName", np.nan)

)

unique_years = structured_data["year"].nunique()

unique_issuers = structured_data["issuerCik"].nunique()

unique_insiders = structured_data["insiderCik"].nunique()

unique_insider_names = structured_data["insiderName"].nunique()

unique_filings = structured_data["accessionNo"].nunique()

unique_tickers = structured_data["issuerInfo.issuerTicker"].nunique()

min_year = structured_data["year"].min()

max_year = structured_data["year"].max()

max_year_full = max_year - 1 # to avoid incomplete data for the current year

print(f"Loaded dataframe with main documents of {form_name} filings")

print(f"Number of filings: {unique_filings:,}")

print(f"Number of records: {len(structured_data):,}")

print(f"Number of years: {unique_years:,} ({min_year}-{max_year})")

# print(f"Number of unique companies: {unique_companies:,}")

print(f"Number of unique issuers: {unique_issuers:,}")

print(f"Number of unique insider ciks: {unique_insiders:,}")

print(f"Number of unique insider names: {unique_insider_names:,}")

print(f"Number of unique ticker symbols found: {unique_tickers:,}")

structured_data.head()

Loaded dataframe with main documents of Form 144 filings

Number of filings: 70,997

Number of records: 70,997

Number of years: 4 (2022-2025)

Number of unique issuers: 3,578

Number of unique insider ciks: 17,431

Number of unique insider names: 17,438

Number of unique ticker symbols found: 3,518

| id | accessionNo | fileNo | formType | filedAt | entities | securitiesInformation | securitiesToBeSold | nothingToReportFlagOnSecuritiesSoldInPast3Months | securitiesSoldInPast3Months | ... | issuerInfo.issuerAddress.street2 | year | month | qtr | dayOfWeek | filedAtClass | issuerCik | issuerName | insiderCik | insiderName | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | f2ce9febeff7a9b6e879a4363b739587 | 0001921094-22-000004 | 001-15525 | 144 | 2022-10-07 14:02:22-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'HUIMIN WANG', 'ad... | ... | NaN | 2022 | 10 | 4 | Friday | regularMarket | 1099800 | Edwards Lifesciences Corp (Subject) | 1204553 | WANG HUIMIN (Reporting) |

| 1 | 567dd75f17174c76d37f00bedfa4c735 | 0000107476-22-000007 | 000-54296 | 144 | 2022-10-07 15:28:02-04:00 | [{'fiscalYearEnd': '0630', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | True | NaN | ... | SUITE 114 | 2022 | 10 | 4 | Friday | regularMarket | 1514946 | AXIM BIOTECHNOLOGIES, INC. (Subject) | 107476 | WILSON-DAVIS & CO., INC. (Reporting) |

| 2 | 7ef0c9ab185899ca8a1d41d6f920638c | 0001921094-22-000006 | 001-37824 | 144 | 2022-10-13 15:33:54-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'CARY BAKER', 'add... | ... | SUITE 1200 | 2022 | 10 | 4 | Thursday | regularMarket | 1114995 | IMPINJ INC (Subject) | 1705407 | Baker Cary (Reporting) |

| 3 | 3ad3feb808dea5da2ee6c92173f4caf2 | 0001921094-22-000008 | 001-37824 | 144 | 2022-10-13 15:42:36-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'CHRIS DIORIO', 'a... | ... | SUITE 1200 | 2022 | 10 | 4 | Thursday | regularMarket | 1114995 | IMPINJ INC (Subject) | 1677721 | DIORIO CHRIS PH.D. (Reporting) |

| 4 | f86981868a5c6b61555386db9ff54aa6 | 0001921094-22-000010 | 001-37824 | 144 | 2022-10-13 15:47:35-04:00 | [{'fiscalYearEnd': '1231', 'stateOfIncorporati... | [{'securitiesClassTitle': 'Common', 'brokerOrM... | [{'securitiesClassTitle': 'Common', 'acquiredD... | False | [{'sellerDetails': {'name': 'JEFF DOSSETT', 'a... | ... | SUITE 1200 | 2022 | 10 | 4 | Thursday | regularMarket | 1114995 | IMPINJ INC (Subject) | 1578147 | DOSSETT JEFFREY (Reporting) |

5 rows × 36 columns

structured_data.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 70997 entries, 0 to 70996

Data columns (total 36 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 id 70997 non-null object

1 accessionNo 70997 non-null object

2 fileNo 70983 non-null object

3 formType 70997 non-null object

4 filedAt 70997 non-null datetime64[ns, US/Eastern]

5 entities 70997 non-null object

6 securitiesInformation 70997 non-null object

7 securitiesToBeSold 70997 non-null object

8 nothingToReportFlagOnSecuritiesSoldInPast3Months 70997 non-null bool

9 securitiesSoldInPast3Months 42550 non-null object

10 remarks 17860 non-null object

11 previousAccessionNumber 916 non-null object

12 issuerInfo.issuerCik 70997 non-null object

13 issuerInfo.issuerName 70997 non-null object

14 issuerInfo.secFileNumber 70997 non-null object

15 issuerInfo.issuerAddress.street1 70997 non-null object

16 issuerInfo.issuerAddress.city 70997 non-null object

17 issuerInfo.issuerAddress.stateOrCountry 70997 non-null object

18 issuerInfo.issuerAddress.zipCode 70997 non-null object

19 issuerInfo.issuerContactPhone 70997 non-null object

20 issuerInfo.nameOfPersonForWhoseAccountTheSecuritiesAreToBeSold 70997 non-null object

21 issuerInfo.relationshipsToIssuer 70997 non-null object

22 issuerInfo.issuerTicker 70880 non-null object

23 noticeSignature.noticeDate 70997 non-null object

24 noticeSignature.signature 70997 non-null object

25 noticeSignature.planAdoptionDates 30312 non-null object

26 issuerInfo.issuerAddress.street2 20036 non-null object

27 year 70997 non-null int32

28 month 70997 non-null int32

29 qtr 70997 non-null int64

30 dayOfWeek 70997 non-null object

31 filedAtClass 70997 non-null object

32 issuerCik 70997 non-null object

33 issuerName 70997 non-null object

34 insiderCik 70978 non-null object

35 insiderName 70978 non-null object

dtypes: bool(1), datetime64[ns, US/Eastern](1), int32(2), int64(1), object(31)

memory usage: 18.5+ MB

def plot_timeseries(ts, title, key="count"):

fig, ax = plt.subplots(figsize=(4, 2.5))

ts[key].plot(ax=ax, legend=False)

ax.set_title(title)

ax.set_xlabel("Year")

ax.set_ylabel(f"Number of\n{form_name} Filings")

ax.set_xticks(np.arange(min_year, max_year + 1, 1))

ax.yaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.set_xlim(min_year - 1, max_year + 1)

ax.grid(axis="x")

ax.set_axisbelow(True)

plt.xticks(rotation=45, ha="right")

for year in range(min_year, max_year + 1, 1):

year_y_max = ts.loc[year, key]

ax.vlines(year, 0, year_y_max, linestyles=":", colors="grey", alpha=0.5, lw=1)

plt.tight_layout()

plt.show()

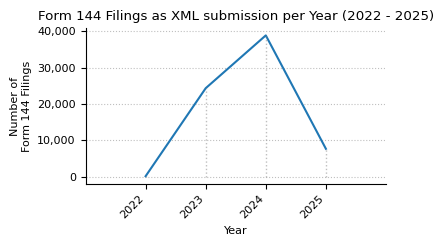

filing_counts = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["year"])

.size()

.to_frame(name="count")

)

plot_timeseries(

filing_counts,

title=f"{form_name} Filings as XML submission per Year ({min_year} - {max_year})",

)

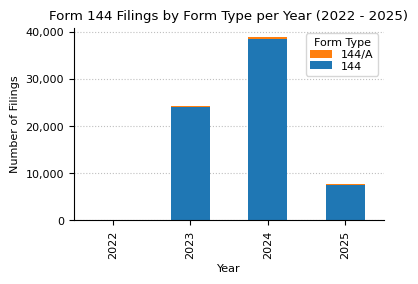

count_formType = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["formType"])

.size()

.sort_values(ascending=False)

.to_frame(name="Count")

).rename_axis("Submission Type")

count_formType["Pct"] = (

count_formType["Count"].astype(int) / count_formType["Count"].astype(int).sum()

).map("{:.0%}".format)

count_formType["Count"] = count_formType["Count"].map(lambda x: f"{x:,}")

print(f"{form_name} Disclosures by Submission Type ({min_year} - {max_year})")

count_formType

Form 144 Disclosures by Submission Type (2022 - 2025)

| Count | Pct | |

|---|---|---|

| Submission Type | ||

| 144 | 70,081 | 99% |

| 144/A | 916 | 1% |

form_counts_by_type_and_year = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["year", "formType"])

.size()

.to_frame(name="count")

.unstack(fill_value=0)

)

form_counts_by_type_and_year.loc["Total"] = form_counts_by_type_and_year.sum()

form_counts_by_type_and_year["Total"] = form_counts_by_type_and_year.sum(axis=1)

print(f"{form_name} counts from {min_year} to {max_year}.")

form_counts_by_type_and_year

Form 144 counts from 2022 to 2025.

| count | Total | ||

|---|---|---|---|

| formType | 144 | 144/A | |

| year | |||

| 2022 | 88 | 1 | 89 |

| 2023 | 23968 | 383 | 24351 |

| 2024 | 38458 | 454 | 38912 |

| 2025 | 7567 | 78 | 7645 |

| Total | 70081 | 916 | 70997 |

fig, ax = plt.subplots(figsize=(4, 2.5))

form_counts_by_type_and_year["count"].drop("Total").plot(

kind="bar", stacked=True, ax=ax

)

ax.set_xlabel("Year")

ax.set_ylabel("Number of Filings")

ax.yaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.grid(axis="x")

ax.set_axisbelow(True)

handles, labels = ax.get_legend_handles_labels()

ax.legend(

list(reversed(handles)),

list(reversed(labels)),

title="Form Type",

labelspacing=0.15,

)

ax.set_title(f"{form_name} Filings by Form Type per Year ({min_year} - {max_year})")

plt.show()

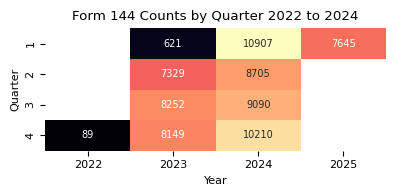

counts_qtr_yr_piv = (

structured_data.groupby(["year", "qtr"]).size().unstack().fillna(0)

).astype(int)

print(f"{form_name} counts by quarter from {min_year} to {max_year}.")

counts_qtr_yr_piv.T

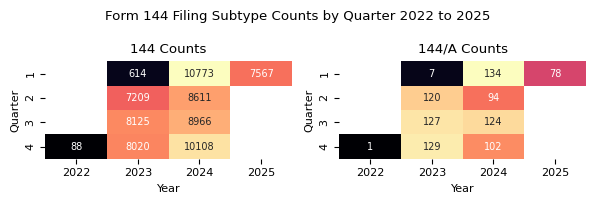

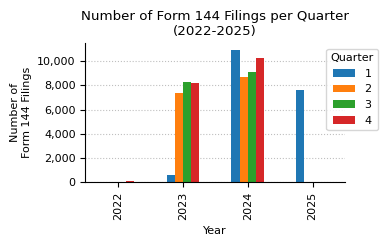

Form 144 counts by quarter from 2022 to 2025.

| year | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| qtr | ||||

| 1 | 0 | 621 | 10907 | 7645 |

| 2 | 0 | 7329 | 8705 | 0 |

| 3 | 0 | 8252 | 9090 | 0 |

| 4 | 89 | 8149 | 10210 | 0 |

plt.figure(figsize=(4, 2))

sns.heatmap(

counts_qtr_yr_piv.T,

annot=True, # Display the cell values

fmt="d", # Integer formatting

cmap="magma", # Color map

cbar_kws={"label": "Count"}, # Colorbar label

mask=counts_qtr_yr_piv.T == 0, # Mask the cells with value 0

cbar=False,

annot_kws={"fontsize": 7},

)

plt.grid(False)

plt.title(f"{form_name} Counts by Quarter {min_year} to {max_year_full}")

plt.xlabel("Year")

plt.ylabel("Quarter")

plt.tight_layout()

plt.show()

form_types = count_formType.index.tolist()

fig, axes = plt.subplots(1, 2, figsize=(6, 2))

cnt = 0

for formType in form_types:

data = (

structured_data[structured_data["formType"] == formType]

.groupby(["year", "qtr"])

.size()

.unstack()

.fillna(0)

.astype(int)

.reindex(columns=range(1, 5), fill_value=0) # ensure all month are included

)

filing_name = formType

# if data.sum().sum() < 100:

# continue

ax = axes.flatten()[cnt]

sns.heatmap(

data.T,

ax=ax,

annot=True, # Display the cell values

fmt="d", # Integer formatting

cmap="magma", # Color map

cbar_kws={"label": "Count"}, # Colorbar label

mask=data.T == 0, # Mask the cells with value 0

cbar=False,

annot_kws={"fontsize": 7},

)

ax.grid(False)

ax.set_title(f"{filing_name} Counts")

ax.set_xlabel("Year")

ax.set_ylabel("Quarter")

cnt += 1

fig.suptitle(f"{form_name} Filing Subtype Counts by Quarter {min_year} to {max_year}")

plt.tight_layout()

counts_qtr_yr = counts_qtr_yr_piv.stack().reset_index(name="count")

fig, ax = plt.subplots(figsize=(4, 2.5))

counts_qtr_yr_piv.plot(kind="bar", ax=ax, legend=True)

ax.legend(title="Quarter", loc="upper right", bbox_to_anchor=(1.15, 1))

ax.set_title(f"Number of {form_name} Filings per Quarter\n({min_year}-{max_year})")

ax.set_xlabel("Year")

ax.set_ylabel(f"Number of\n{form_name} Filings")

ax.yaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.grid(axis="x")

ax.set_axisbelow(True)

plt.tight_layout()

plt.show()

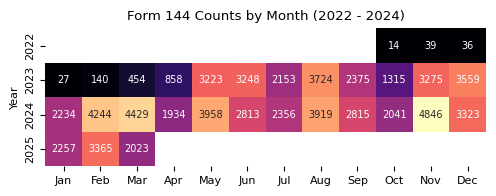

counts_month_yr_piv = (

structured_data.groupby(["year", "month"]).size().unstack().fillna(0)

).astype(int)

plt.figure(figsize=(5, 2))

sns.heatmap(

counts_month_yr_piv,

annot=True,

fmt="d",

cmap="magma",

cbar_kws={"label": "Count"},

mask=counts_month_yr_piv == 0,

cbar=False,

annot_kws={"size": 7},

)

# convert x-labels to month names: 1 => Jan, 2 => Feb, etc.

plt.xticks(

ticks=np.arange(0.5, 12.5, 1),

labels=[pd.to_datetime(str(i), format="%m").strftime("%b") for i in range(1, 13)],

)

plt.grid(False)

plt.title(f"{form_name} Counts by Month ({min_year} - {max_year_full})")

plt.xlabel("")

plt.ylabel("Year")

plt.tight_layout()

plt.show()

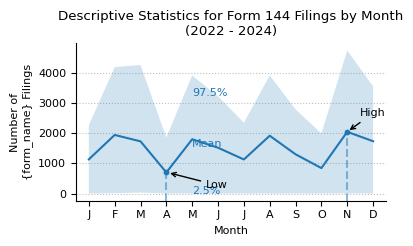

print(

f"Descriptive statistics for {form_name} filing counts by month from {min_year} to {max_year}."

)

month_stats = (

counts_month_yr_piv.loc[2004:]

.describe(percentiles=[0.025, 0.975])

.round(0)

.astype(int)

)

month_stats

Descriptive statistics for Form 144 filing counts by month from 2022 to 2025.

| month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| mean | 1130 | 1937 | 1726 | 698 | 1795 | 1515 | 1127 | 1911 | 1298 | 842 | 2040 | 1730 |

| std | 1289 | 2187 | 1999 | 918 | 2095 | 1759 | 1304 | 2208 | 1509 | 1009 | 2420 | 1979 |

| min | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2.5% | 2 | 11 | 34 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 3 | 3 |

| 50% | 1130 | 1752 | 1238 | 429 | 1612 | 1406 | 1076 | 1862 | 1188 | 664 | 1657 | 1680 |

| 97.5% | 2255 | 4178 | 4249 | 1853 | 3903 | 3215 | 2341 | 3904 | 2782 | 1987 | 4728 | 3541 |

| max | 2257 | 4244 | 4429 | 1934 | 3958 | 3248 | 2356 | 3919 | 2815 | 2041 | 4846 | 3559 |

def plot_box_plot_as_line(

data: pd.DataFrame,

x_months=True,

title="",

x_label="",

x_pos_mean_label=2,

pos_labels=None,

pos_high_low=None,

y_label="",

y_formatter=lambda x, p: "{:.0f}".format(int(x) / 1000),

show_high_low_labels=True,

show_inline_labels=True,

show_bands=True,

figsize=(4, 2.5),

line_source="mean",

):

fig, ax = plt.subplots(figsize=figsize)

line_to_plot = data[line_source]

lower_label = "2.5%"

upper_label = "97.5%"

lower = data[lower_label]

upper = data[upper_label]

line_to_plot.plot(ax=ax)

if show_bands:

ax.fill_between(line_to_plot.index, lower, upper, alpha=0.2)

if x_months:

ax.set_xlim(0.5, 12.5)

ax.set_xticks(range(1, 13))

ax.set_xticklabels(["J", "F", "M", "A", "M", "J", "J", "A", "S", "O", "N", "D"])

ax.yaxis.set_major_formatter(mtick.FuncFormatter(y_formatter))

ax.set_ylabel(y_label)

ax.set_xlabel(x_label)

ax.set_title(title)

ymin, ymax = ax.get_ylim()

y_scale = ymax - ymin

max_x = int(line_to_plot.idxmax())

max_y = line_to_plot.max()

min_x = int(line_to_plot.idxmin())

min_y = line_to_plot.min()

ax.axvline(

max_x,

ymin=0,

ymax=((max_y - ymin) / (ymax - ymin)),

linestyle="dashed",

color="tab:blue",

alpha=0.5,

)

ax.scatter(max_x, max_y, color="tab:blue", s=10)

ax.axvline(

min_x,

ymin=0,

ymax=((min_y - ymin) / (ymax - ymin)),

linestyle="dashed",

color="tab:blue",

alpha=0.5,

)

ax.scatter(min_x, min_y, color="tab:blue", s=10)

x_pos_mean_label_int = int(x_pos_mean_label)

if show_inline_labels:

mean_x = x_pos_mean_label

mean_y = line_to_plot.iloc[x_pos_mean_label_int] * 1.02

upper_x = x_pos_mean_label

upper_y = upper.iloc[x_pos_mean_label_int]

lower_x = x_pos_mean_label

lower_y = lower.iloc[x_pos_mean_label_int] * 0.95

if pos_labels:

mean_x = pos_labels["mean"]["x"]

mean_y = pos_labels["mean"]["y"]

upper_x = pos_labels["upper"]["x"]

upper_y = pos_labels["upper"]["y"]

lower_x = pos_labels["lower"]["x"]

lower_y = pos_labels["lower"]["y"]

ax.text(mean_x, mean_y, "Mean", color="tab:blue", fontsize=8)

ax.text(upper_x, upper_y, upper_label, color="tab:blue", fontsize=8)

ax.text(lower_x, lower_y, lower_label, color="tab:blue", fontsize=8)

if show_high_low_labels:

high_x_origin = max_x

high_y_origin = max_y

high_x_label = high_x_origin + 0.5

high_y_label = high_y_origin + 0.1 * y_scale

if pos_high_low:

high_x_label = pos_high_low["high"]["x"]

high_y_label = pos_high_low["high"]["y"]

ax.annotate(

"High",

(high_x_origin, high_y_origin),

xytext=(high_x_label, high_y_label),

arrowprops=dict(facecolor="black", arrowstyle="->"),

)

low_x_origin = min_x * 1.01

low_y_origin = min_y

low_x_label = low_x_origin + 1.5

low_y_label = low_y_origin - 0.1 * y_scale

if pos_high_low:

low_x_label = pos_high_low["low"]["x"]

low_y_label = pos_high_low["low"]["y"]

ax.annotate(

"Low",

(low_x_origin, low_y_origin),

xytext=(low_x_label, low_y_label),

arrowprops=dict(facecolor="black", arrowstyle="->"),

)

ax.grid(axis="x")

ax.set_axisbelow(True)

plt.tight_layout()

plt.show()

plot_box_plot_as_line(

data=month_stats.T,

title=f"Descriptive Statistics for {form_name} Filings by Month\n({min_year} - {max_year_full})",

x_label="Month",

y_label="Number of\n{form_name} Filings",

y_formatter=lambda x, p: "{:.0f}".format(int(x)),

x_pos_mean_label=5,

)

form_types = count_formType.index.tolist()

fig, axes = plt.subplots(1, 2, figsize=(5.5, 2))

cnt = 0

for formType in form_types:

data = (

structured_data[structured_data["formType"] == formType]

.groupby(["year", "month"])

.size()

.unstack()

.fillna(0)

.reindex(columns=range(1, 13), fill_value=0) # ensure all month are included

)

# if data.sum().sum() < 100:

# continue

ax = axes.flatten()[cnt]

cnt += 1

try:

data.boxplot(

ax=ax,

grid=False,

showfliers=False,

flierprops=dict(marker="o", markersize=3),

patch_artist=True,

boxprops=dict(facecolor="white", color="tab:blue"),

showmeans=True,

meanline=True,

meanprops={"color": "tab:blue", "linestyle": ":"},

medianprops={"color": "black"},

capprops={"color": "none"},

)

ax.set_title(f"Form {formType}")

ax.set_xlabel("")

ax.set_ylabel(f"Form {formType} Count")

xticklabels = [

pd.to_datetime(str(x), format="%m").strftime("%b") for x in range(1, 13)

]

ax.set_xticklabels(xticklabels)

ax.tick_params(axis="x", rotation=45)

except Exception as e:

print(f"Error: {e}")

# disable the empty subplots

for i in range(cnt, len(axes.flatten())):

axes.flatten()[i].axis("off")

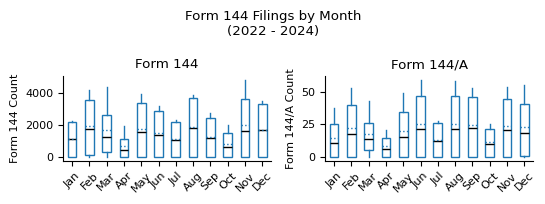

fig.suptitle(f"{form_name} Filings by Month\n({min_year} - {max_year_full})")

plt.tight_layout()

plt.show()

counts_per_month_by_formType = (

structured_data[["year", "month", "accessionNo", "formType"]]

.groupby(["year", "month", "formType"])

.count()

.rename(columns={"accessionNo": "count"})

.pivot_table(

index=["year", "month"], # Rows

columns="formType", # Columns

values="count", # Values to fill

fill_value=0, # Replace NaN with 0

)

.astype(int)

.reset_index() # Make year and month normal columns

)

counts_per_month_by_formType

| formType | year | month | 144 | 144/A |

|---|---|---|---|---|

| 0 | 2022 | 10 | 14 | 0 |

| 1 | 2022 | 11 | 39 | 0 |

| 2 | 2022 | 12 | 35 | 1 |

| 3 | 2023 | 1 | 27 | 0 |

| 4 | 2023 | 2 | 140 | 0 |

| 5 | 2023 | 3 | 447 | 7 |

| 6 | 2023 | 4 | 846 | 12 |

| 7 | 2023 | 5 | 3174 | 49 |

| 8 | 2023 | 6 | 3189 | 59 |

| 9 | 2023 | 7 | 2128 | 25 |

| 10 | 2023 | 8 | 3666 | 58 |

| 11 | 2023 | 9 | 2331 | 44 |

| 12 | 2023 | 10 | 1295 | 20 |

| 13 | 2023 | 11 | 3221 | 54 |

| 14 | 2023 | 12 | 3504 | 55 |

| 15 | 2024 | 1 | 2196 | 38 |

| 16 | 2024 | 2 | 4191 | 53 |

| 17 | 2024 | 3 | 4386 | 43 |

| 18 | 2024 | 4 | 1913 | 21 |

| 19 | 2024 | 5 | 3928 | 30 |

| 20 | 2024 | 6 | 2770 | 43 |

| 21 | 2024 | 7 | 2328 | 28 |

| 22 | 2024 | 8 | 3876 | 43 |

| 23 | 2024 | 9 | 2762 | 53 |

| 24 | 2024 | 10 | 2016 | 25 |

| 25 | 2024 | 11 | 4805 | 41 |

| 26 | 2024 | 12 | 3287 | 36 |

| 27 | 2025 | 1 | 2236 | 21 |

| 28 | 2025 | 2 | 3329 | 36 |

| 29 | 2025 | 3 | 2002 | 21 |

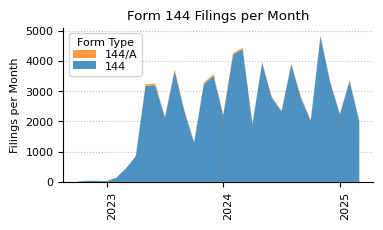

fix, ax = plt.subplots(figsize=(4, 2))

ax.stackplot(

counts_per_month_by_formType["year"].astype(str)

+ "-"

+ counts_per_month_by_formType["month"].astype(str),

*[counts_per_month_by_formType[ft] for ft in form_types],

labels=[f"{ft}" for ft in form_types],

alpha=0.8,

)

handles, labels = ax.get_legend_handles_labels()

ax.legend(

list(reversed(handles)),

list(reversed(labels)),

title="Form Type",

labelspacing=0.15,

)

ax.set_title(f"{form_name} Filings per Month")

ax.set_ylabel("Filings per Month")

xticks = (

counts_per_month_by_formType["year"].astype(str)

+ "-"

+ counts_per_month_by_formType["month"].astype(str)

)

ax.set_xticks([i for i, x in enumerate(xticks) if x.endswith("-1")])

ax.set_xticklabels(

[label.get_text()[:4] for label in ax.get_xticklabels()], rotation=90, ha="left"

)

ax.grid(axis="y", linestyle=":", alpha=0.5)

ax.spines["top"].set_visible(False)

ax.spines["right"].set_visible(False)

# draw vertical lines for each first month of the year, dotted, transparency 0.5,

# with height of the y value for the respective month

for year, month in counts_per_month_by_formType[["year", "month"]].values:

if month == 1:

ax.vlines(

f"{year}-{month}",

ymin=0,

ymax=counts_per_month_by_formType[

(counts_per_month_by_formType["year"] == year)

& (counts_per_month_by_formType["month"] == month)

]

.drop(columns=["year", "month"])

.sum(axis=1),

linestyle=":",

alpha=0.5,

color="grey",

)

plt.show()

counts_filedAtClass = (

(

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["filedAtClass"])

.size()

.sort_values(ascending=False)

.to_frame(name="Count")

)

.rename_axis("Publication Time")

.sort_values("Count", ascending=True)

)

counts_filedAtClass["Pct"] = (

counts_filedAtClass["Count"].astype(int)

/ counts_filedAtClass["Count"].astype(int).sum()

).map("{:.0%}".format)

counts_filedAtClass["Count"] = counts_filedAtClass["Count"].map(lambda x: f"{x:,}")

counts_filedAtClass.index = (

counts_filedAtClass.index.str.replace("preMarket", "Pre-Market (4:00 - 9:30 AM)")

.str.replace("marketHours", "Market Hours (9:30 AM - 4:00 PM)")

.str.replace("afterMarket", "After Market (4:00 - 8:00 PM)")

)

counts_filedAtClass = counts_filedAtClass.reindex(counts_filedAtClass.index[::-1])

print(

f"{form_name} filing counts by pre-market, regular market hours,\n"

f"and after-market publication time ({min_year} - {max_year_full})."

)

counts_filedAtClass

Form 144 filing counts by pre-market, regular market hours,

and after-market publication time (2022 - 2024).

| Count | Pct | |

|---|---|---|

| Publication Time | ||

| After Market (4:00 - 8:00 PM) | 46,775 | 66% |

| regularMarket | 19,532 | 28% |

| other | 2,615 | 4% |

| Pre-Market (4:00 - 9:30 AM) | 2,075 | 3% |

counts_dayOfWeek = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["dayOfWeek"])

.size()

.to_frame(name="Count")

).rename_axis("Day of the Week")

counts_dayOfWeek["Pct"] = (

counts_dayOfWeek["Count"].astype(int) / counts_dayOfWeek["Count"].astype(int).sum()

).map("{:.0%}".format)

counts_dayOfWeek["Count"] = counts_dayOfWeek["Count"].map(lambda x: f"{x:,}")

print(f"{form_name} filing counts by day of the week ({min_year} - {max_year}).")

counts_dayOfWeek.loc[["Monday", "Tuesday", "Wednesday", "Thursday", "Friday"]]

Form 144 filing counts by day of the week (2022 - 2025).

| Count | Pct | |

|---|---|---|

| Day of the Week | ||

| Monday | 15,389 | 22% |

| Tuesday | 15,498 | 22% |

| Wednesday | 13,461 | 19% |

| Thursday | 13,032 | 18% |

| Friday | 13,617 | 19% |

counts_insider_type = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["issuerInfo.relationshipsToIssuer"])

.size()

.to_frame(name="Count")

).rename_axis("Insider Type")

counts_insider_type.sort_values("Count", ascending=False, inplace=True)

counts_insider_type["Pct"] = (

counts_insider_type["Count"].astype(int)

/ counts_insider_type["Count"].astype(int).sum()

).map("{:.1%}".format)

counts_insider_type["Count"] = counts_insider_type["Count"].map(lambda x: f"{x:,}")

print(f"{form_name} filing counts by Insider Type ({min_year} - {max_year}).")

counts_insider_type.head(10)

Form 144 filing counts by Insider Type (2022 - 2025).

| Count | Pct | |

|---|---|---|

| Insider Type | ||

| Officer | 47,725 | 67.2% |

| Director | 13,305 | 18.7% |

| Affiliate | 1,920 | 2.7% |

| 10% Stockholder | 1,790 | 2.5% |

| Former Officer | 737 | 1.0% |

| Shareholder | 456 | 0.6% |

| Affiliated Entity | 438 | 0.6% |

| Former Director | 258 | 0.4% |

| Member of immediate family of any of the foregoing | 246 | 0.3% |

| affiliate | 191 | 0.3% |

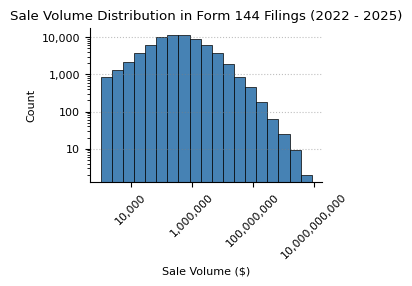

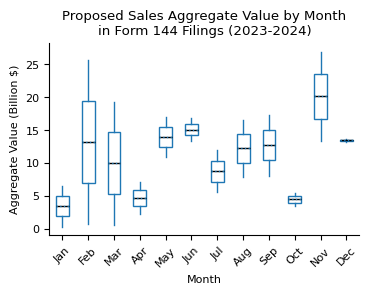

Aggregate Sales Volume

In this section we analyze the aggregate value of the proposed sales. Please note that a filer might not actually exercise the sales proposed in the notifications but might exercise the sale within 90 days of the notification.

structured_data["proposedSalesAggregateValue"] = structured_data[

"securitiesInformation"

].apply(lambda l: sum([float(v.get("aggregateMarketValue", 0)) for v in l]))

structured_data["maxStockPriceInAggregateValue"] = structured_data[

"securitiesInformation"

].apply(

lambda l: sum(

[

(

float(v.get("aggregateMarketValue", 0))

/ float(v.get("noOfUnitsSold", np.nan))

if float(v.get("noOfUnitsSold", np.nan)) > 0

else 0

)

for v in l

]

)

)

# need to filter because some filers specify market cap as aggregateMarketValue

# instead of the aggregate values of the shares they intend to sell

aggregate_value_threshold = 1000

plausible_aggregate_market_values = structured_data[

structured_data["maxStockPriceInAggregateValue"] < aggregate_value_threshold

]

# this strategy likely excludes some legitimate filings, but it's a good starting point

# for a more accurate analysis, one could check the stock price at the time of filing

# and compare it with the aggregateMarketValue for the filings with high stock prices

print(

f"Number of filers reporting aggregate market values corresponding"

f" to stock prices above ${aggregate_value_threshold:,}:"

)

print(

len(

structured_data[

structured_data["maxStockPriceInAggregateValue"]

>= aggregate_value_threshold

]["accessionNo"]

.apply(lambda x: x.split("-")[0])

.unique()

)

)

print("Total number of filers in Form 144 dataset:")

print(len(structured_data["accessionNo"].apply(lambda x: x.split("-")[0]).unique()))

print(

f"Number of filings with aggregate market values corresponding"

f" to stock prices above ${aggregate_value_threshold:,}:"

)

print(

len(

structured_data[

structured_data["maxStockPriceInAggregateValue"]

>= aggregate_value_threshold

]

)

)

Number of filers reporting aggregate market values corresponding to stock prices above $1,000:

39

Total number of filers in Form 144 dataset:

1107

Number of filings with aggregate market values corresponding to stock prices above $1,000:

472

data = plausible_aggregate_market_values["proposedSalesAggregateValue"]

data = data[data > 1000]

def plot_hist(

data,

title,

x_label,

y_label,

log_scale=False,

xlog_scale=False,

ylog_scale=False,

bins=None,

xticks=None,

):

if log_scale:

xlog_scale = True

ylog_scale = True

fig, ax = plt.subplots(figsize=(3, 2))

if bins is None:

if xlog_scale:

bin_edges = np.logspace(np.log10(min(data)), np.log10(max(data)), num=20)

else:

bin_edges = bins

else:

bin_edges = bins

ax.hist(

data,

bins=bin_edges,

color="steelblue",

edgecolor="black",

linewidth=0.5,

)

if xticks is not None:

ax.set_xticks(xticks)

if log_scale:

ax.set_xscale("log")

ax.xaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.tick_params(axis="x", rotation=45)

if ylog_scale:

ax.set_yscale("log")

ax.yaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.set_title(title)

ax.set_xlabel(x_label)

ax.set_ylabel(y_label)

return fig, ax

plot_hist(

data,

title=f"Sale Volume Distribution in {form_name} Filings ({min_year} - {max_year})",

x_label="Sale Volume ($)",

y_label="Count",

log_scale=True,

)

plt.show()

# sort by proposedSalesAggregateValue and return the top 10

top_10_sales = plausible_aggregate_market_values.sort_values(

"proposedSalesAggregateValue", ascending=False

).head(10)

print(

f"Top 10 {form_name} Filings by Proposed Sales Aggregate Value ({min_year} - {max_year})."

)

top_10_sales[

[

"insiderName",

"issuerName",

"issuerInfo.issuerTicker",

"proposedSalesAggregateValue",

"maxStockPriceInAggregateValue",

"filedAt",

]

].reset_index(drop=True).assign(

proposedSalesAggregateValue=lambda x: x["proposedSalesAggregateValue"].map(

"{:,.0f}".format

),

maxStockPriceInAggregateValue=lambda x: x["maxStockPriceInAggregateValue"].map(

"{:,.2f}".format

),

filedAt=lambda x: x["filedAt"].dt.strftime("%Y-%m-%d"),

insiderName=lambda x: x["insiderName"].str.replace(r" (Reporting)", ""),

issuerName=lambda x: x["issuerName"].str.replace(r" (Subject)", ""),

).rename(

columns={

"insiderName": "Insider Name",

"issuerName": "Issuer Name",

"issuerInfo.issuerTicker": "Issuer Ticker",

"proposedSalesAggregateValue": "Aggregate Value ($)",

"maxStockPriceInAggregateValue": "Stock Price ($)",

"filedAt": "Filed At",

}

)

Top 10 Form 144 Filings by Proposed Sales Aggregate Value (2022 - 2025).

| Insider Name | Issuer Name | Issuer Ticker | Aggregate Value ($) | Stock Price ($) | Filed At | |

|---|---|---|---|---|---|---|

| 0 | BEZOS JEFFREY P | AMAZON COM INC | AMZN | 8,457,500,000 | 169.15 | 2024-02-07 |

| 1 | DEUTSCHE TELEKOM AG | T-Mobile US, Inc. | TMUS | 5,801,501,826 | 361.38 | 2024-06-10 |

| 2 | BEZOS JEFFREY P | AMAZON COM INC | AMZN | 4,930,000,000 | 197.20 | 2024-07-02 |

| 3 | DEUTSCHE TELEKOM AG | T-Mobile US, Inc. | TMUS | 3,595,927,501 | 155.71 | 2023-12-26 |

| 4 | Mastercard Foundation | Mastercard Inc | MA | 3,583,008,000 | 459.36 | 2024-08-15 |

| 5 | DEUTSCHE TELEKOM AG | T-Mobile US, Inc. | TMUS | 3,310,419,375 | 164.76 | 2024-03-11 |

| 6 | BEZOS JEFFREY P | AMAZON COM INC | AMZN | 3,048,501,168 | 186.40 | 2024-11-01 |

| 7 | TD Luxembourg International Holdings S.a r.l. | SCHWAB CHARLES CORP | SCHW | 2,626,020,000 | 129.68 | 2024-08-21 |

| 8 | Walton Family Holdings Trust | Walmart Inc. | WMT | 2,011,800,000 | 167.65 | 2023-11-17 |

| 9 | Mastercard Foundation | Mastercard Inc | MA | 1,913,058,000 | 455.49 | 2024-05-10 |

aggregate_value_per_month = (

plausible_aggregate_market_values[["year", "month", "proposedSalesAggregateValue"]]

.groupby(["year", "month"])

.sum()

.rename(columns={"accessionNo": "count"})

.pivot_table(

index=["year", "month"], # Rows

values="proposedSalesAggregateValue", # Values to fill

fill_value=0, # Replace NaN with 0

)

.astype(int)

.reset_index() # Make year and month normal columns

)

def plot_timeseries_year_month(ts, title, key="count", multiplier=1, ylabel=None):

fig, ax = plt.subplots(figsize=(3.5, 2.5))

# use first month of the year as major ticks and month as minor

month_labels = aggregate_value_per_month["month"].astype(str)

year_labels = aggregate_value_per_month["year"].astype(str)

year_ticks = [n for n, m in enumerate(month_labels) if m == "1"]

year_ticklabels = [y for y, m in zip(year_labels, month_labels) if m == "1"]

values = ts[key] * multiplier

ax.plot(range(len(values)), values)

ax.set_title(title)

ax.yaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.set_ylabel(ylabel)

ax.set_xlabel("Year")

ax.set_axisbelow(True)

# set minor ticks for months

ax.set_xticks(

range(len(values)),

minor=True,

)

ax.set_xticks(year_ticks, minor=False)

ax.set_xticklabels(year_ticklabels)

plt.xticks(rotation=45, va="top", ha="center")

for year in ts["year"].unique():

# get the maximum value for the year at month 1

year_y_max = (

ts.loc[(ts["year"] == year) & (ts["month"] == 1), key].max() * multiplier

)

x = ts.loc[ts["year"] == year, "month"].idxmin()

ax.vlines(x, 0, year_y_max, linestyles=":", colors="grey", alpha=0.5, lw=1)

plt.tight_layout()

plt.show()

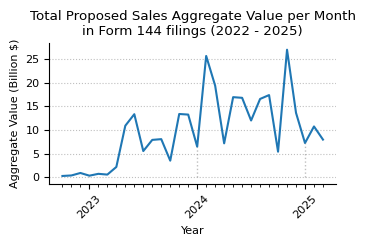

plot_timeseries_year_month(

aggregate_value_per_month,

title=f"Total Proposed Sales Aggregate Value per Month"

f"\nin {form_name} filings ({min_year} - {max_year})",

key="proposedSalesAggregateValue",

multiplier=1e-9,

ylabel="Aggregate Value (Billion $)",

)

data = (

plausible_aggregate_market_values[

plausible_aggregate_market_values["year"].isin([2023, 2024])

][["year", "month", "proposedSalesAggregateValue"]]

.groupby(["year", "month"])

.sum()

.multiply(1e-9)

.unstack()

.fillna(0)

)

fig, ax = plt.subplots(figsize=(4, 2.5))

data.boxplot(

ax=ax,

grid=False,

showfliers=False,

flierprops=dict(marker="o", markersize=3),

patch_artist=True,

boxprops=dict(facecolor="white", color="tab:blue"),

showmeans=True,

meanline=True,

meanprops={"color": "tab:blue", "linestyle": ":"},

medianprops={"color": "black"},

capprops={"color": "none"},

)

ax.set_title(

f"Proposed Sales Aggregate Value by Month\nin {form_name} Filings (2023-2024)"

)

ax.set_xlabel("Month")

ax.set_ylabel("Aggregate Value (Billion $)")

xticklabels = [pd.to_datetime(str(x), format="%m").strftime("%b") for x in range(1, 13)]

ax.set_xticklabels(xticklabels)

ax.tick_params(axis="x", rotation=45)

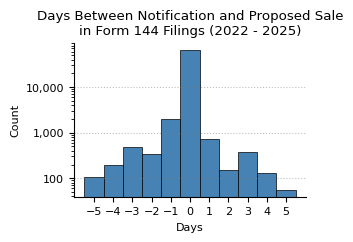

Sales Timing

In this section we long securities were held and analyze how much in advance of the planned sale notifications are filed.

structured_data["firstProposedDate"] = pd.to_datetime(

structured_data["securitiesInformation"].apply(

lambda x: min([v.get("approxSaleDate", np.nan) for v in x])

)

)

# securities sold in one sale can have different dates of acquisition

# as a simple approximation, we take the minimum date of acquisition

structured_data["acquiredDate"] = pd.to_datetime(

structured_data["securitiesToBeSold"].apply(

lambda x: min([v.get("acquiredDate", np.nan) for v in x])

)

)

structured_data["filedAtDate"] = pd.to_datetime(structured_data["filedAt"].dt.date)

structured_data["daysBetweenNotificationAndSale"] = (

structured_data["firstProposedDate"] - structured_data["filedAtDate"]

).dt.days

plot_hist(

structured_data["daysBetweenNotificationAndSale"].loc[

structured_data["daysBetweenNotificationAndSale"].between(-5, 5)

],

title=f"Days Between Notification and Proposed Sale\n"

f"in {form_name} Filings ({min_year} - {max_year})",

x_label="Days",

y_label="Count",

ylog_scale=True,

bins=np.arange(-6, 6) + 0.5,

xticks=np.arange(-5, 6),

)

plt.show()

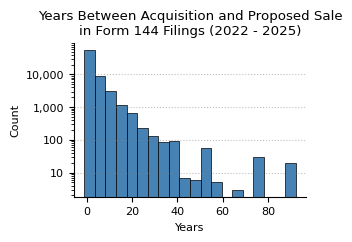

structured_data["yearsBetweenAcquisitionAndSale"] = (

structured_data["firstProposedDate"] - structured_data["acquiredDate"]

).dt.days / 365.2425

plot_hist(

structured_data["yearsBetweenAcquisitionAndSale"],

title=f"Years Between Acquisition and Proposed Sale\n"

f"in {form_name} Filings ({min_year} - {max_year})",

x_label="Years",

y_label="Count",

ylog_scale=True,

bins=20,

)

plt.show()