Analysis of Financial Restatements and Non-Reliance Disclosures

We illustrate how to perform an exploratory data analysis on disclosures informing investors about non-reliance of previously issued financial statements (also known as financial restatements) of publicly traded companies on U.S. stock exchanges. These financial restatements are disclosed in Form 8-K filings with the SEC, specifically under Item 4.02, titled "Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review." These disclosures are presented in text form by companies. Utilizing our Structured Data API, we extract and structure the relevant information from the text, making it available for detailed analysis.

Our analysis will focus on several key areas:

- Number of Item 4.02 disclosures made each year from 2004 to 2023, per quarter, month and at what time of the day (pre-market, regular market, after-market).

- Distribution of disclosures across structured data fields, such as the proportion of disclosures reporting material weaknesses in internal controls.

- Identification of the party most often responsible for discovering the issue, whether it was the company itself, its auditor, or the SEC.

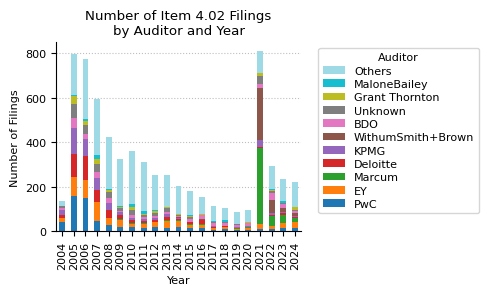

- Number of times an auditor was involved in the restatement process.

- Number of reporting periods (quarters or years) affected by each restatement.

- Statistics concerning the financial statement items impacted by the restatements.

Data Loading and Preparation

To load and prepare the data, we will use the Form 8-K Item 4.02 Structured Data API to download all structured data related to Form 8-K filings that include Item 4.02 disclosures. The data spanning the years 2004 to 2024 is saved in a JSONL file ./form-8k-item-4-02-structured-data.jsonl.

import os

import json

import re

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import matplotlib.style as style

import matplotlib.ticker as mtick

style.use("default")

params = {

"axes.labelsize": 8, "font.size": 8, "legend.fontsize": 8,

"xtick.labelsize": 8, "ytick.labelsize": 8, "font.family": "sans-serif",

"axes.spines.top": False, "axes.spines.right": False, "grid.color": "grey",

"axes.grid": True, "axes.grid.axis": "y", "grid.alpha": 0.5, "grid.linestyle": ":",

}

plt.rcParams.update(params)

!pip install sec-api

from sec_api import Form_8K_Item_X_Api

item_X_api = Form_8K_Item_X_Api("YOUR_API_KEY")

YEARS = range(2024, 2003, -1) # from 2024 to 2004

TARGET_FILE = "./form-8k-item-4-02-structured-data.jsonl"

if not os.path.exists(TARGET_FILE):

for year in YEARS:

done = False

search_from = 0

year_counter = 0

while not done:

searchRequest = {

"query": f"item4_02:* AND filedAt:[{year}-01-01 TO {year}-12-31]",

"from": search_from,

"size": "50",

"sort": [{"filedAt": {"order": "desc"}}],

}

response = item_X_api.get_data(searchRequest)

if len(response["data"]) == 0:

break

search_from += 50

year_counter += len(response["data"])

with open(TARGET_FILE, "a") as f:

for entry in response["data"]:

f.write(json.dumps(entry) + "\n")

print(f"Finished loading {year_counter} Item 4.02 for year {year}")

else:

print("File already exists, skipping download")

Finished loading 240 Item 4.02 for year 2024

Finished loading 262 Item 4.02 for year 2023

Finished loading 304 Item 4.02 for year 2022

Finished loading 864 Item 4.02 for year 2021

Finished loading 96 Item 4.02 for year 2020

Finished loading 98 Item 4.02 for year 2019

Finished loading 132 Item 4.02 for year 2018

Finished loading 141 Item 4.02 for year 2017

Finished loading 173 Item 4.02 for year 2016

Finished loading 216 Item 4.02 for year 2015

Finished loading 243 Item 4.02 for year 2014

Finished loading 326 Item 4.02 for year 2013

Finished loading 349 Item 4.02 for year 2012

Finished loading 402 Item 4.02 for year 2011

Finished loading 458 Item 4.02 for year 2010

Finished loading 465 Item 4.02 for year 2009

Finished loading 576 Item 4.02 for year 2008

Finished loading 786 Item 4.02 for year 2007

Finished loading 1057 Item 4.02 for year 2006

Finished loading 1013 Item 4.02 for year 2005

Finished loading 172 Item 4.02 for year 2004

Standardization of Data Fields

The following section includes boilerplate code used to normalize various fields and enhance the dataset by deriving additional variables through field combinations. For example, the Item 4.02 dataset contains information on affected financial statement line items as disclosed in non-reliance filings. However, these line items often lack standard nomenclature, deviating from US GAAP definitions. To address this, we apply standardization techniques, such as converting "net loss" to "net income" or "cost of goods sold" to "cost of sales."

The approach described below primarily relies on regular expressions (regex) to identify and normalize patterns, which effectively standardizes the majority of cases. However, some inconsistencies remain, leading to a small portion of false positives. For the purposes of this analysis, the error rate is considered negligible.

A similar standardization process is applied to auditor names, ensuring consistency across entries. For instance, some companies report their auditor as "Ernst & Young," while others use the abbreviation "EY." These variations are unified under a single standardized label to improve data consistency and facilitate accurate analysis.

def standardize_affected_line_item(affected_line_item):

item = affected_line_item.lower()

item = re.sub(r"(net revenue.?|net sales)", "revenue", item, flags=re.IGNORECASE)

item = re.sub(r"net loss", "net income", item, flags=re.IGNORECASE)

item = re.sub(r"^net income \(loss\)$", "net income", item, flags=re.IGNORECASE)

item = re.sub(

r"^net income per share$", "earnings per share", item, flags=re.IGNORECASE

)

item = re.sub(

r"^total current liabilities$", "current liabilities", item, flags=re.IGNORECASE

)

item = re.sub(

r"^total current assets$", "current assets", item, flags=re.IGNORECASE

)

item = re.sub(r"^liabilities$", "total liabilities", item, flags=re.IGNORECASE)

item = re.sub(r"^assets$", "total assets", item, flags=re.IGNORECASE)

item = re.sub(r"^earnings$", "net income", item, flags=re.IGNORECASE)

item = re.sub(

r"^derivative liability$", "derivative liabilities", item, flags=re.IGNORECASE

)

item = re.sub(

r"^additional paid in capital$",

"additional paid-in capital",

item,

flags=re.IGNORECASE,

)

item = re.sub(r"^cost of goods sold$", "cost of sales", item, flags=re.IGNORECASE)

item = re.sub(

r"total stockholders' equity|total shareholders' equity|shareholders' equity|shareholder's equity|stockholders' equity|equity section|temporary equity|equity classification",

"equity",

item,

flags=re.IGNORECASE,

)

item = re.sub(r"^total equity$", "equity", item, flags=re.IGNORECASE)

# earnings per share calculation => earnings per share

item = re.sub(

r"earnings per share calculation|diluted earnings per share|earnings per share \(eps\)|diluted net income \(loss\) per share|loss per share",

"earnings per share",

item,

flags=re.IGNORECASE,

)

item = re.sub(r"^net sales$", "revenue", item, flags=re.IGNORECASE)

item = re.sub(r"^revenues$", "revenue", item, flags=re.IGNORECASE)

return item

def standardize_affected_line_items(affected_line_items):

if isinstance(affected_line_items, list):

return [standardize_affected_line_item(item) for item in affected_line_items]

return affected_line_items

def standardize_auditor(auditor: str) -> str:

substitutions = [

(r"\.|,", ""),

(r"LLP", ""),

(r" LLC", ""),

(r" PLLC", ""),

(r"BDO .*", "BDO"),

(r".*PwC.*", "PricewaterhouseCoopers"),

(r"PricewaterhouseCoopers", "PwC"),

(r"Deloitte & Touche", "Deloitte"),

(r"Ernst & Young", "EY"),

(r"(.*)?Malone & Bailey(.*)?", "MaloneBailey"),

(r"(.*)?WithumSmith(.*)?", "WithumSmith+Brown"),

]

for pattern, replacement in substitutions:

auditor = re.sub(pattern, replacement, auditor, flags=re.IGNORECASE)

# set to empty string if the following patterns are found

to_empty_string_patterns = [

(r"Independent registered public accounting firm", ""),

(r"independent registered public", ""),

(r"Not specified", ""),

(r"Not explicitly mentioned", ""),

(r"Independent accountant", ""),

(r"NaN", ""),

(r"Unknown", ""),

]

for pattern, replacement in to_empty_string_patterns:

# check if pattern is found in auditor. if yes, return empty string

if re.search(pattern, auditor, flags=re.IGNORECASE):

return "Unknown"

if auditor == "":

return "Unknown"

return auditor.strip()

def standardize_auditors(auditors):

if isinstance(auditors, list):

return [standardize_auditor(auditor) for auditor in auditors]

return auditors

structured_data = pd.read_json(TARGET_FILE, lines=True)

# add date-related columns

structured_data["filedAt"] = pd.to_datetime(structured_data["filedAt"], utc=True)

structured_data["filedAt"] = structured_data["filedAt"].dt.tz_convert("US/Eastern")

structured_data["year"] = structured_data["filedAt"].dt.year

structured_data["month"] = structured_data["filedAt"].dt.month

structured_data["qtr"] = structured_data["filedAt"].dt.quarter

structured_data["dayOfWeek"] = structured_data["filedAt"].dt.day_name()

# filedAtClass: preMarket (4:00AM-9:30AM), regularMarket (9:30AM-4:00PM), afterMarket (4:00PM-8:00PM)

structured_data["filedAtClass"] = structured_data["filedAt"].apply(

lambda x: (

"preMarket"

if x.hour < 9 or (x.hour == 9 and x.minute < 30)

else (

"regularMarket"

if x.hour < 16

else "afterMarket" if x.hour < 20 else "other"

)

)

)

# convert long-form of each item into item id only, e.g. "Item 4.02: ..." => "4.02"

structured_data["items"] = structured_data["items"].apply(

lambda items: [re.search(r"\d+\.\d+", x).group(0) if x else None for x in items]

)

# explode column "item4_02" into multiple columns

# where each column is a key-value pair of the JSON object

# and drop all structured data columns for items, eg "item5_02"

item_cols = list(

structured_data.columns[

structured_data.columns.str.contains(r"item\d+_", case=False)

]

)

structured_data = pd.concat(

[

structured_data.drop(item_cols, axis=1),

structured_data["item4_02"].apply(pd.Series),

],

axis=1,

)

# drop "id" column

structured_data.drop(["id"], axis=1, inplace=True)

# standardize affected line itmes

structured_data["affectedLineItems"] = structured_data["affectedLineItems"].apply(

standardize_affected_line_items

)

# standardize auditor names

structured_data["auditors"] = structured_data["auditors"].apply(standardize_auditors)

# add "hasBig4Auditor" (bool). True if auditor is one of the Big 4 (Deloitte, EY, KPMG, PwC)

structured_data["hasBig4Auditor"] = structured_data["auditors"].apply(

lambda x: any(auditor in ["Deloitte", "EY", "KPMG", "PwC"] for auditor in x)

)

# add column: "numberPeriodsAffected" = number of periods affected

structured_data["numberPeriodsAffected"] = structured_data[

"affectedReportingPeriods"

].apply(lambda x: len(x) if isinstance(x, list) else 0)

# add column: "numberQuartersAffected" = number of "Q\d" occurrences in "affectedReportingPeriods"

structured_data["numberQuartersAffected"] = structured_data[

"affectedReportingPeriods"

].apply(lambda x: len([period for period in x if re.search(r"Q\d", period)]))

# add column: "numberYearsAffected" = number of "FY" occurrences in "affectedReportingPeriods"

structured_data["numberYearsAffected"] = structured_data[

"affectedReportingPeriods"

].apply(lambda x: len([period for period in x if re.search(r"FY", period)]))

# add "reportedWithEarnings" (bool). True if item 2.02 or 9.01 is present

structured_data["reportedWithEarnings"] = structured_data["items"].apply(

lambda x: "2.02" in x or "9.01" in x

)

# add "reportedWithOtherItems" (bool). True if more than one item is present

structured_data["reportedWithOtherItems"] = structured_data["items"].apply(

lambda x: len(x) > 1

)

# add column "issueIdentifiedByAuditor" (bool).

structured_data["identifiedByAuditor"] = structured_data["identifiedBy"].apply(

lambda x: "Auditor" in x if isinstance(x, list) else False

)

# add column "identifiedByCompany"

structured_data["identifiedByCompany"] = structured_data["identifiedBy"].apply(

lambda x: "Company" in x if isinstance(x, list) else False

)

# add column "identifiedBySec"

structured_data["identifiedBySec"] = structured_data["identifiedBy"].apply(

lambda x: "SEC" in x if isinstance(x, list) else False

)

# check if revenue or net income adjustment contains "million" or "billion"

structured_data["revenueAdjustmentContainsWordMillion"] = structured_data[

"revenueAdjustment"

].apply(

# lambda x: "million" in x if isinstance(x, str) else False

# use case insensitive regex to match "million" or "billion" and return boolean

# True if match, False otherwise

lambda x: (

bool(re.search(r"million|billion", x, re.IGNORECASE))

if isinstance(x, str)

else False

)

)

structured_data["netIncomeAdjustmentContainsWordMillion"] = structured_data[

"netIncomeAdjustment"

].apply(

lambda x: (

bool(re.search(r"million|billion", x, re.IGNORECASE))

if isinstance(x, str)

else False

)

)

print(

f"Loaded {len(structured_data):,} records from Item 4.02 disclosures between 2004 to 2024."

)

structured_data.head()

Loaded 8,373 records from Item 4.02 disclosures between 2004 to 2024.

| accessionNo | formType | filedAt | periodOfReport | cik | ticker | companyName | items | year | month | ... | numberPeriodsAffected | numberQuartersAffected | numberYearsAffected | reportedWithEarnings | reportedWithOtherItems | identifiedByAuditor | identifiedByCompany | identifiedBySec | revenueAdjustmentContainsWordMillion | netIncomeAdjustmentContainsWordMillion | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0001477932-24-008354 | 8-K | 2024-12-27 17:29:12-05:00 | 2024-12-24 | 1437750 | TRXA | T-REX Acquisition Corp. | [4.02, 5.02] | 2024 | 12 | ... | 1 | 0 | 1 | False | True | True | True | False | False | False |

| 1 | 0001437749-24-038225 | 8-K | 2024-12-23 08:00:28-05:00 | 2024-12-20 | 1000230 | OCC | OPTICAL CABLE CORP | [4.02] | 2024 | 12 | ... | 7 | 6 | 1 | False | False | False | True | False | False | False |

| 2 | 0001683168-24-008906 | 8-K | 2024-12-23 07:52:53-05:00 | 2024-12-19 | 725394 | DFCO | DALRADA FINANCIAL CORP | [4.02] | 2024 | 12 | ... | 1 | 1 | 0 | False | False | False | True | False | False | False |

| 3 | 0001437749-24-038156 | 8-K | 2024-12-20 17:15:00-05:00 | 2024-12-19 | 914122 | PPIH | Perma-Pipe International Holdings, Inc. | [4.02] | 2024 | 12 | ... | 1 | 1 | 0 | False | False | False | True | False | False | False |

| 4 | 0001140361-24-049546 | 8-K | 2024-12-13 17:16:31-05:00 | 2024-12-10 | 1856028 | SDIG | Stronghold Digital Mining, Inc. | [4.02, 9.01] | 2024 | 12 | ... | 3 | 3 | 0 | True | True | False | True | True | False | False |

5 rows × 43 columns

item_4_02_counts = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["year"])

.size()

.to_frame(name="count")

)

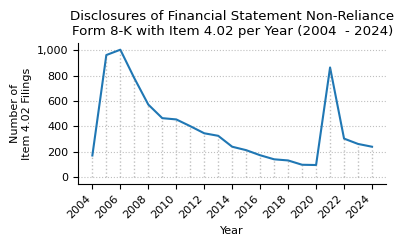

print(f"Item 4.02 counts from 2004 to 2024.")

item_4_02_counts.T

Item 4.02 counts from 2004 to 2024.

| year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | ... | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 171 | 962 | 1004 | 780 | 572 | 465 | 455 | 402 | 346 | 326 | ... | 213 | 173 | 141 | 132 | 98 | 96 | 864 | 304 | 262 | 240 |

1 rows × 21 columns

def plot_timeseries(ts, title):

fig, ax = plt.subplots(figsize=(4, 2.5))

ts["count"].plot(ax=ax, legend=False)

ax.set_title(title)

ax.set_xlabel("Year")

ax.set_ylabel("Number of\nItem 4.02 Filings")

ax.set_xticks(np.arange(2004, 2025, 2))

ax.yaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.set_xlim(2003, 2025)

ax.grid(axis="x")

ax.set_axisbelow(True)

plt.xticks(rotation=45, ha="right")

for year in YEARS:

year_y_max = ts.loc[year, "count"]

ax.vlines(year, 0, year_y_max, linestyles=":", colors="grey", alpha=0.5, lw=1)

plt.tight_layout()

plt.show()

plot_timeseries(

item_4_02_counts,

title="Disclosures of Financial Statement Non-Reliance\nForm 8-K with Item 4.02 per Year (2004 - 2024)",

)

structured_data["qtr"] = structured_data["month"].apply(lambda x: (x - 1) // 3 + 1)

counts_qtr_yr_piv = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["year", "qtr"])

.size()

.unstack()

.fillna(0)

).astype(int)

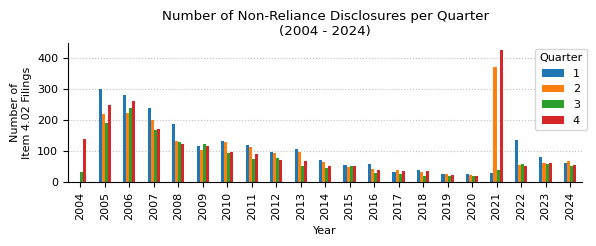

print(f"Item 4.02 counts by quarter from 2004 to 2024.")

counts_qtr_yr_piv.T

Item 4.02 counts by quarter from 2004 to 2024.

| year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | ... | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| qtr | |||||||||||||||||||||

| 1 | 0 | 301 | 281 | 239 | 187 | 118 | 132 | 120 | 99 | 106 | ... | 57 | 59 | 34 | 41 | 27 | 28 | 29 | 136 | 80 | 61 |

| 2 | 0 | 221 | 222 | 201 | 132 | 105 | 131 | 115 | 95 | 97 | ... | 49 | 42 | 41 | 34 | 28 | 24 | 370 | 56 | 62 | 70 |

| 3 | 33 | 190 | 239 | 168 | 130 | 124 | 94 | 76 | 79 | 54 | ... | 54 | 31 | 28 | 20 | 20 | 22 | 39 | 59 | 59 | 52 |

| 4 | 138 | 250 | 262 | 172 | 123 | 118 | 98 | 91 | 73 | 69 | ... | 53 | 41 | 38 | 37 | 23 | 22 | 426 | 53 | 61 | 57 |

4 rows × 21 columns

counts_qtr_yr = counts_qtr_yr_piv.stack().reset_index(name="count")

fig, ax = plt.subplots(figsize=(6, 2.5))

counts_qtr_yr_piv.plot(kind="bar", ax=ax, legend=True)

ax.legend(title="Quarter", loc="upper right", bbox_to_anchor=(1.02, 1))

ax.set_title("Number of Non-Reliance Disclosures per Quarter\n(2004 - 2024)")

ax.set_xlabel("Year")

ax.set_ylabel("Number of\nItem 4.02 Filings")

ax.yaxis.set_major_formatter(mtick.StrMethodFormatter("{x:,.0f}"))

ax.grid(axis="x")

ax.set_axisbelow(True)

plt.tight_layout()

plt.show()

counts_month_yr_piv = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["year", "month"])

.size()

.unstack()

.fillna(0)

).astype(int)

print(f"Item 4.02 counts by month from 2004 to 2024.")

counts_month_yr_piv

Item 4.02 counts by month from 2004 to 2024.

| month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| year | ||||||||||||

| 2004 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 7 | 26 | 29 | 63 | 46 |

| 2005 | 37 | 89 | 175 | 85 | 91 | 45 | 46 | 91 | 53 | 63 | 123 | 64 |

| 2006 | 45 | 84 | 152 | 81 | 78 | 63 | 60 | 115 | 64 | 76 | 109 | 77 |

| 2007 | 60 | 67 | 112 | 85 | 62 | 54 | 41 | 91 | 36 | 53 | 76 | 43 |

| 2008 | 40 | 74 | 73 | 63 | 45 | 24 | 32 | 62 | 36 | 31 | 60 | 32 |

| 2009 | 33 | 40 | 45 | 50 | 33 | 22 | 31 | 46 | 47 | 36 | 58 | 24 |

| 2010 | 37 | 41 | 54 | 49 | 48 | 34 | 23 | 47 | 24 | 34 | 32 | 32 |

| 2011 | 24 | 26 | 70 | 49 | 39 | 27 | 28 | 31 | 17 | 30 | 45 | 16 |

| 2012 | 26 | 28 | 45 | 39 | 31 | 25 | 26 | 35 | 18 | 26 | 38 | 9 |

| 2013 | 18 | 40 | 48 | 41 | 36 | 20 | 11 | 29 | 14 | 15 | 39 | 15 |

| 2014 | 16 | 25 | 31 | 22 | 26 | 19 | 11 | 24 | 12 | 17 | 26 | 11 |

| 2015 | 10 | 19 | 28 | 24 | 21 | 4 | 20 | 19 | 15 | 18 | 25 | 10 |

| 2016 | 17 | 14 | 28 | 15 | 21 | 6 | 9 | 11 | 11 | 5 | 25 | 11 |

| 2017 | 10 | 9 | 15 | 20 | 11 | 10 | 7 | 15 | 6 | 10 | 21 | 7 |

| 2018 | 12 | 14 | 15 | 14 | 13 | 7 | 3 | 11 | 6 | 16 | 15 | 6 |

| 2019 | 6 | 7 | 14 | 12 | 10 | 6 | 9 | 8 | 3 | 8 | 10 | 5 |

| 2020 | 2 | 13 | 13 | 9 | 12 | 3 | 8 | 10 | 4 | 7 | 11 | 4 |

| 2021 | 4 | 10 | 15 | 54 | 264 | 52 | 20 | 11 | 8 | 6 | 271 | 149 |

| 2022 | 38 | 46 | 52 | 23 | 23 | 10 | 6 | 38 | 15 | 13 | 30 | 10 |

| 2023 | 9 | 25 | 46 | 24 | 28 | 10 | 10 | 28 | 21 | 17 | 25 | 19 |

| 2024 | 10 | 23 | 28 | 33 | 31 | 6 | 11 | 27 | 14 | 20 | 23 | 14 |

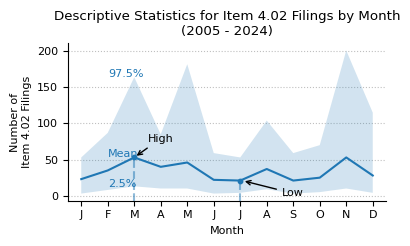

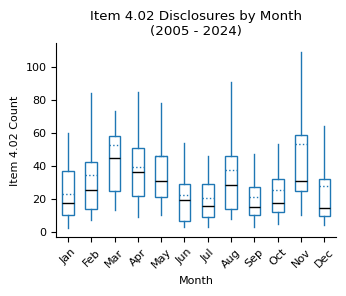

print(f"Descriptive statistics for Item 4.02 counts by month from 2005 to 2024.")

month_stats = (

counts_month_yr_piv.loc[2005:]

.describe(percentiles=[0.025, 0.975])

.round(0)

.astype(int)

)

month_stats

Descriptive statistics for Item 4.02 counts by month from 2005 to 2024.

| month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 | 20 |

| mean | 23 | 35 | 53 | 40 | 46 | 22 | 21 | 37 | 21 | 25 | 53 | 28 |

| std | 16 | 25 | 45 | 24 | 56 | 18 | 15 | 30 | 17 | 19 | 60 | 35 |

| min | 2 | 7 | 13 | 9 | 10 | 3 | 3 | 8 | 3 | 5 | 10 | 4 |

| 2.5% | 3 | 8 | 13 | 10 | 10 | 3 | 4 | 9 | 3 | 5 | 10 | 4 |

| 50% | 18 | 26 | 45 | 36 | 31 | 20 | 16 | 28 | 15 | 18 | 31 | 14 |

| 97.5% | 53 | 87 | 164 | 85 | 182 | 59 | 53 | 104 | 59 | 70 | 201 | 115 |

| max | 60 | 89 | 175 | 85 | 264 | 63 | 60 | 115 | 64 | 76 | 271 | 149 |

def plot_box_plot_as_line(

data: pd.DataFrame,

x_months=True,

title="",

x_label="",

x_pos_mean_label=2,

pos_labels=None, # {"mean": {"x": 2, "y": 150}, "upper": {"x": 2, "y": 150}, "lower": {"x": 2, "y": 150}},

pos_high_low=None, # {"high": {"x": 2, "y": 150}, "low": {"x": 2, "y": 150}},

y_label="",

y_formatter=lambda x, p: "{:.0f}".format(int(x) / 1000),

show_high_low_labels=True,

show_inline_labels=True,

show_bands=True,

figsize=(4, 2.5),

line_source="mean",

):

fig, ax = plt.subplots(figsize=figsize)

line_to_plot = data[line_source]

lower_label = "2.5%"

upper_label = "97.5%"

lower = data[lower_label]

upper = data[upper_label]

line_to_plot.plot(ax=ax)

if show_bands:

ax.fill_between(line_to_plot.index, lower, upper, alpha=0.2)

if x_months:

ax.set_xlim(0.5, 12.5)

ax.set_xticks(range(1, 13))

ax.set_xticklabels(["J", "F", "M", "A", "M", "J", "J", "A", "S", "O", "N", "D"])

ax.yaxis.set_major_formatter(mtick.FuncFormatter(y_formatter))

ax.set_ylabel(y_label)

ax.set_xlabel(x_label)

ax.set_title(title)

ymin, ymax = ax.get_ylim()

y_scale = ymax - ymin

max_x = int(line_to_plot.idxmax())

max_y = line_to_plot.max()

min_x = int(line_to_plot.idxmin())

min_y = line_to_plot.min()

ax.axvline(

max_x,

ymin=0,

ymax=((max_y - ymin) / (ymax - ymin)),

linestyle="dashed",

color="tab:blue",

alpha=0.5,

)

ax.scatter(max_x, max_y, color="tab:blue", s=10)

ax.axvline(

min_x,

ymin=0,

ymax=((min_y - ymin) / (ymax - ymin)),

linestyle="dashed",

color="tab:blue",

alpha=0.5,

)

ax.scatter(min_x, min_y, color="tab:blue", s=10)

x_pos_mean_label_int = int(x_pos_mean_label)

if show_inline_labels:

mean_x = x_pos_mean_label

mean_y = line_to_plot.iloc[x_pos_mean_label_int] * 1.02

upper_x = x_pos_mean_label

upper_y = upper.iloc[x_pos_mean_label_int]

lower_x = x_pos_mean_label

lower_y = lower.iloc[x_pos_mean_label_int] * 0.95

if pos_labels:

mean_x = pos_labels["mean"]["x"]

mean_y = pos_labels["mean"]["y"]

upper_x = pos_labels["upper"]["x"]

upper_y = pos_labels["upper"]["y"]

lower_x = pos_labels["lower"]["x"]

lower_y = pos_labels["lower"]["y"]

ax.text(mean_x, mean_y, "Mean", color="tab:blue", fontsize=8)

ax.text(upper_x, upper_y, upper_label, color="tab:blue", fontsize=8)

ax.text(lower_x, lower_y, lower_label, color="tab:blue", fontsize=8)

if show_high_low_labels:

high_x_origin = max_x

high_y_origin = max_y

high_x_label = high_x_origin + 0.5

high_y_label = high_y_origin + 0.1 * y_scale

if pos_high_low:

high_x_label = pos_high_low["high"]["x"]

high_y_label = pos_high_low["high"]["y"]

ax.annotate(

"High",

(high_x_origin, high_y_origin),

xytext=(high_x_label, high_y_label),

arrowprops=dict(facecolor="black", arrowstyle="->"),

)

low_x_origin = min_x * 1.01

low_y_origin = min_y

low_x_label = low_x_origin + 1.5

low_y_label = low_y_origin - 0.1 * y_scale

if pos_high_low:

low_x_label = pos_high_low["low"]["x"]

low_y_label = pos_high_low["low"]["y"]

ax.annotate(

"Low",

(low_x_origin, low_y_origin),

xytext=(low_x_label, low_y_label),

arrowprops=dict(facecolor="black", arrowstyle="->"),

)

ax.grid(axis="x")

ax.set_axisbelow(True)

plt.tight_layout()

plt.show()

plot_box_plot_as_line(

data=month_stats.T,

title="Descriptive Statistics for Item 4.02 Filings by Month\n(2005 - 2024)",

x_label="Month",

y_label="Number of\nItem 4.02 Filings",

y_formatter=lambda x, p: "{:.0f}".format(int(x)),

)

fig, ax = plt.subplots(figsize=(3.5, 3))

counts_month_yr_piv.loc[2005:].boxplot(

ax=ax,

grid=False,

showfliers=False,

flierprops=dict(marker="o", markersize=3),

patch_artist=True,

boxprops=dict(facecolor="white", color="tab:blue"),

showmeans=True,

meanline=True,

meanprops={"color": "tab:blue", "linestyle": ":"},

medianprops={"color": "black"},

capprops={"color": "none"},

)

ax.set_title("Item 4.02 Disclosures by Month\n(2005 - 2024)")

ax.set_xlabel("Month")

ax.set_ylabel("Item 4.02 Count")

xticklabels = [pd.to_datetime(str(x), format="%m").strftime("%b") for x in range(1, 13)]

ax.set_xticklabels(xticklabels)

plt.xticks(rotation=45)

plt.tight_layout()

plt.show()

counts_filedAtClass = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["filedAtClass"])

.size()

.sort_values(ascending=False)

.to_frame(name="Count")

).rename_axis("Publication Time")

counts_filedAtClass["Pct"] = (

counts_filedAtClass["Count"].astype(int)

/ counts_filedAtClass["Count"].astype(int).sum()

).map("{:.0%}".format)

counts_filedAtClass["Count"] = counts_filedAtClass["Count"].map(lambda x: f"{x:,}")

counts_filedAtClass.index = (

counts_filedAtClass.index.str.replace("preMarket", "Pre-Market (4:00 - 9:30 AM)")

.str.replace("regularMarket", "Market Hours (9:30 AM - 4:00 PM)")

.str.replace("afterMarket", "After Market (4:00 - 8:00 PM)")

)

counts_filedAtClass = counts_filedAtClass.reindex(counts_filedAtClass.index[::-1])

print(

f"Item 4.02 counts by pre-market, regular market hours,\nand after-market publication time (2004 - 2025)."

)

counts_filedAtClass

Item 4.02 counts by pre-market, regular market hours,

and after-market publication time (2004 - 2025).

| Count | Pct | |

|---|---|---|

| Publication Time | ||

| other | 304 | 4% |

| Pre-Market (4:00 - 9:30 AM) | 943 | 11% |

| Market Hours (9:30 AM - 4:00 PM) | 2,049 | 25% |

| After Market (4:00 - 8:00 PM) | 4,950 | 60% |

counts_dayOfWeek = (

structured_data.drop_duplicates(subset=["accessionNo"])

.groupby(["dayOfWeek"])

.size()

.to_frame(name="Count")

).rename_axis("Day of the Week")

counts_dayOfWeek["Pct"] = (

counts_dayOfWeek["Count"].astype(int) / counts_dayOfWeek["Count"].astype(int).sum()

).map("{:.0%}".format)

counts_dayOfWeek["Count"] = counts_dayOfWeek["Count"].map(lambda x: f"{x:,}")

print(f"Item 4.02 disclosures by day of the week (2004 - 2024).")

counts_dayOfWeek.loc[["Monday", "Tuesday", "Wednesday", "Thursday", "Friday"]]

Item 4.02 disclosures by day of the week (2004 - 2024).

| Count | Pct | |

|---|---|---|

| Day of the Week | ||

| Monday | 1,639 | 20% |

| Tuesday | 1,705 | 21% |

| Wednesday | 1,532 | 19% |

| Thursday | 1,560 | 19% |

| Friday | 1,810 | 22% |

bool_variables_to_analyze = [

"impactIsMaterial",

"restatementIsNecessary",

"impactYetToBeDetermined",

"materialWeaknessIdentified",

"reportedWithOtherItems",

"reportedWithEarnings",

"netIncomeDecreased",

"netIncomeIncreased",

"netIncomeAdjustmentContainsWordMillion",

"revenueDecreased",

"revenueIncreased",

"revenueAdjustmentContainsWordMillion",

"identifiedByAuditor",

"identifiedByCompany",

"identifiedBySec",

]

var_to_label = {

"impactIsMaterial": "Impact is Material",

"restatementIsNecessary": "Restatement is Necessary",

"impactYetToBeDetermined": "Impact Yet to be Determined",

"materialWeaknessIdentified": "Material Weakness Identified",

"reportedWithOtherItems": "Reported with Other Items",

"reportedWithEarnings": "Reported with Earnings Announcement",

"netIncomeDecreased": "Net Income Decreased",

"netIncomeIncreased": "Net Income Increased",

"netIncomeAdjustmentContainsWordMillion": "Net Inc. Adj. Contains 'Million'",

"revenueDecreased": "Revenue Decreased",

"revenueIncreased": "Revenue Increased",

"revenueAdjustmentContainsWordMillion": "Revenue Adj. Contains 'Million'",

"identifiedByAuditor": "Identified by Auditor",

"identifiedByCompany": "Identified by Company",

"identifiedBySec": "Identified by SEC",

}

bool_variables_stats = []

for variable in bool_variables_to_analyze:

variable_stats = (

structured_data[variable]

.value_counts()

.to_frame()

.reset_index()

.rename(columns={variable: "value"})

)

variable_stats = variable_stats.sort_values(by="value", ascending=False)

variable_stats["pct"] = (

variable_stats["count"] / variable_stats["count"].sum() * 100

).round(1)

variable_stats.index = pd.MultiIndex.from_tuples(

[(variable, row["value"]) for _, row in variable_stats.iterrows()],

)

variable_stats.drop(columns="value", inplace=True)

bool_variables_stats.append(variable_stats)

bool_variables_stats = pd.concat(bool_variables_stats, axis=0)

bool_variables_stats.index.set_names(["Variable", "Value"], inplace=True)

bool_variables_stats.rename(index=var_to_label, columns={"count": "Samples", "pct": "Pct."}, inplace=True)

bool_variables_stats["Samples"] = bool_variables_stats["Samples"].apply(lambda x: f"{x:,.0f}")

print(f"Number of non-reliance filings by \ntheir disclosed characteristics (2004 - 2024):")

bool_variables_stats

Number of non-reliance filings by

their disclosed characteristics (2004 - 2024):

| Samples | Pct. | ||

|---|---|---|---|

| Variable | Value | ||

| Impact is Material | True | 6,224 | 74.3 |

| False | 2,149 | 25.7 | |

| Restatement is Necessary | True | 8,155 | 97.4 |

| False | 218 | 2.6 | |

| Impact Yet to be Determined | True | 2,052 | 24.5 |

| False | 6,321 | 75.5 | |

| Material Weakness Identified | True | 2,241 | 26.8 |

| False | 6,132 | 73.2 | |

| Reported with Other Items | True | 3,676 | 43.9 |

| False | 4,697 | 56.1 | |

| Reported with Earnings Announcement | True | 3,248 | 38.8 |

| False | 5,125 | 61.2 | |

| Net Income Decreased | True | 2,084 | 24.9 |

| False | 6,289 | 75.1 | |

| Net Income Increased | True | 758 | 9.1 |

| False | 7,615 | 90.9 | |

| Net Inc. Adj. Contains 'Million' | True | 449 | 5.4 |

| False | 7,924 | 94.6 | |

| Revenue Decreased | True | 633 | 7.6 |

| False | 7,740 | 92.4 | |

| Revenue Increased | True | 204 | 2.4 |

| False | 8,169 | 97.6 | |

| Revenue Adj. Contains 'Million' | True | 196 | 2.3 |

| False | 8,177 | 97.7 | |

| Identified by Auditor | True | 2,173 | 26.0 |

| False | 6,200 | 74.0 | |

| Identified by Company | True | 6,996 | 83.6 |

| False | 1,377 | 16.4 | |

| Identified by SEC | True | 1,279 | 15.3 |

| False | 7,094 | 84.7 |

identifiedBy = (

structured_data["identifiedBy"].explode().value_counts().to_frame().head(3)

)

identifiedBy.index.name = "Identified By"

identifiedBy.columns = ["Count"]

identifiedBy["Pct."] = identifiedBy["Count"] / identifiedBy["Count"].sum() * 100

identifiedBy["Pct."] = identifiedBy["Pct."].round(1)

identifiedBy["Count"] = identifiedBy["Count"].apply(lambda x: f"{x:,.0f}")

print(

f"Top 3 entities identifying issues in\npreviously reported financial statements (2004 - 2024):"

)

identifiedBy

Top 3 entities identifying issues in

previously reported financial statements (2004 - 2024):

| Count | Pct. | |

|---|---|---|

| Identified By | ||

| Company | 6,996 | 67.0 |

| Auditor | 2,173 | 20.8 |

| SEC | 1,279 | 12.2 |

all_auditors = structured_data["auditors"].explode()

all_auditors = all_auditors[all_auditors.str.len() > 0].reset_index(drop=True)

auditors = all_auditors.value_counts().to_frame().reset_index()

auditors["pct"] = auditors["count"] / auditors["count"].sum() * 100

auditors["pct"] = auditors["pct"].round(2)

print("Top 10 auditors involved in \nnon-reliance disclosures from 2004 to 2024:")

auditors.head(10)

Top 10 auditors involved in

non-reliance disclosures from 2004 to 2024:

| auditors | count | pct | |

|---|---|---|---|

| 0 | PwC | 639 | 9.50 |

| 1 | EY | 598 | 8.89 |

| 2 | Marcum | 477 | 7.09 |

| 3 | Deloitte | 436 | 6.48 |

| 4 | KPMG | 430 | 6.39 |

| 5 | WithumSmith+Brown | 335 | 4.98 |

| 6 | BDO | 327 | 4.86 |

| 7 | Unknown | 324 | 4.82 |

| 8 | Grant Thornton | 179 | 2.66 |

| 9 | MaloneBailey | 100 | 1.49 |

auditors_year = structured_data[["auditors", "year", "accessionNo"]].explode("auditors")

auditors_year_pivot = pd.pivot_table(

auditors_year,

index="auditors",

columns="year",

values="accessionNo",

aggfunc="count",

fill_value=0,

)

auditors_year_pivot["total"] = auditors_year_pivot.sum(axis=1)

auditors_year_pivot = auditors_year_pivot.sort_values(by="total", ascending=False)

top_10_auditors = auditors_year_pivot.head(10)

others = auditors_year_pivot[~auditors_year_pivot.index.isin(top_10_auditors.index)]

others = others.sum().to_frame().T

others.index = ["Others"]

top_10_auditors = pd.concat([top_10_auditors, others], axis=0)

top_10_auditors

| year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | ... | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PwC | 42 | 159 | 149 | 48 | 28 | 21 | 20 | 14 | 18 | 17 | ... | 16 | 5 | 11 | 6 | 6 | 9 | 10 | 13 | 13 | 639 |

| EY | 20 | 87 | 83 | 85 | 31 | 31 | 12 | 18 | 25 | 31 | ... | 14 | 8 | 7 | 3 | 7 | 24 | 16 | 26 | 28 | 598 |

| Marcum | 0 | 0 | 0 | 0 | 0 | 3 | 5 | 5 | 1 | 4 | ... | 3 | 2 | 1 | 5 | 5 | 340 | 45 | 36 | 18 | 477 |

| Deloitte | 11 | 103 | 104 | 54 | 38 | 20 | 13 | 10 | 8 | 11 | ... | 16 | 5 | 3 | 0 | 1 | 6 | 2 | 9 | 6 | 436 |

| KPMG | 24 | 116 | 78 | 54 | 30 | 13 | 11 | 10 | 7 | 15 | ... | 4 | 3 | 0 | 4 | 5 | 29 | 10 | 4 | 5 | 430 |

| WithumSmith+Brown | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 2 | ... | 4 | 0 | 0 | 0 | 0 | 237 | 58 | 17 | 13 | 335 |

| BDO | 8 | 44 | 23 | 26 | 24 | 2 | 12 | 6 | 11 | 7 | ... | 15 | 15 | 17 | 11 | 13 | 18 | 33 | 17 | 10 | 327 |

| Unknown | 7 | 63 | 40 | 35 | 25 | 14 | 20 | 10 | 12 | 19 | ... | 1 | 5 | 1 | 4 | 2 | 36 | 6 | 4 | 1 | 324 |

| Grant Thornton | 4 | 34 | 20 | 23 | 10 | 7 | 14 | 3 | 11 | 3 | ... | 3 | 0 | 3 | 1 | 3 | 10 | 6 | 3 | 16 | 179 |

| MaloneBailey | 0 | 8 | 9 | 19 | 3 | 4 | 14 | 15 | 2 | 1 | ... | 1 | 2 | 6 | 1 | 0 | 2 | 2 | 5 | 1 | 100 |

| Others | 19 | 181 | 267 | 251 | 234 | 211 | 240 | 219 | 158 | 143 | ... | 77 | 67 | 58 | 54 | 56 | 97 | 105 | 101 | 112 | 2883 |

11 rows × 22 columns

fig, ax = plt.subplots(figsize=(5, 3))

top_10_auditors.drop(columns="total").T.plot(

kind="bar", stacked=True, ax=ax, cmap="tab20"

)

ax.set_title("Number of Item 4.02 Filings\nby Auditor and Year")

ax.set_xlabel("Year")

ax.set_ylabel("Number of Filings")

ax.xaxis.grid(False)

ax.set_axisbelow(True)

handles, labels = ax.get_legend_handles_labels() # reverse order of legend items

ax.legend(

reversed(handles),

reversed(labels),

title="Auditor",

bbox_to_anchor=(1.05, 1),

labelspacing=0.3,

fontsize=8,

)

plt.tight_layout()

plt.show()

print(

f"Descriptive statistics for number of years and quarters \naffected by Item 4.02 filings (2004 - 2024):"

)

quarters_stats = (

structured_data[["numberQuartersAffected", "numberYearsAffected"]]

.describe()

.round(0)

.astype(int)

)

quarters_stats.T

Descriptive statistics for number of years and quarters

affected by Item 4.02 filings (2004 - 2024):

| count | mean | std | min | 25% | 50% | 75% | max | |

|---|---|---|---|---|---|---|---|---|

| numberQuartersAffected | 8373 | 2 | 3 | 0 | 1 | 2 | 3 | 56 |

| numberYearsAffected | 8373 | 1 | 1 | 0 | 0 | 1 | 2 | 20 |

affectedLineItems_stats = (

structured_data["affectedLineItems"]

.explode()

.value_counts()

.to_frame()

.reset_index()

.head(10)

)

print(

f"Top 10 line items affected by non-reliance disclosures\nacross all years (2004 - 2024):"

)

affectedLineItems_stats

Top 10 line items affected by non-reliance disclosures

across all years (2004 - 2024):

| affectedLineItems | count | |

|---|---|---|

| 0 | net income | 2346 |

| 1 | equity | 1075 |

| 2 | revenue | 966 |

| 3 | total liabilities | 679 |

| 4 | additional paid-in capital | 672 |

| 5 | earnings per share | 564 |

| 6 | accumulated deficit | 543 |

| 7 | total assets | 450 |

| 8 | retained earnings | 404 |

| 9 | warrants | 334 |

line_items_year_pivot = pd.pivot_table(

structured_data.explode("affectedLineItems"),

index="affectedLineItems",

columns="year",

values="accessionNo",

aggfunc="count",

fill_value=0,

margins=True,

)

line_items_year_pivot = line_items_year_pivot.sort_values(by="All", ascending=False)

print(f"Top 20 line items affected by Item 4.02 filings per year (2004 - 2023):")

line_items_year_pivot.head(20)

Top 20 line items affected by Item 4.02 filings per year (2004 - 2023):

| year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | ... | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | All |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| affectedLineItems | |||||||||||||||||||||

| All | 508 | 3089 | 3468 | 2424 | 2114 | 1684 | 1757 | 1422 | 1142 | 1171 | ... | 610 | 394 | 402 | 367 | 346 | 2256 | 903 | 850 | 784 | 27320 |

| net income | 55 | 348 | 301 | 226 | 208 | 127 | 159 | 118 | 95 | 85 | ... | 42 | 27 | 30 | 34 | 31 | 152 | 59 | 65 | 41 | 2346 |

| equity | 11 | 65 | 109 | 49 | 45 | 43 | 58 | 50 | 27 | 42 | ... | 14 | 7 | 13 | 15 | 7 | 403 | 47 | 26 | 13 | 1075 |

| revenue | 31 | 150 | 104 | 81 | 70 | 48 | 46 | 50 | 37 | 48 | ... | 29 | 26 | 21 | 22 | 22 | 23 | 28 | 36 | 30 | 966 |

| total liabilities | 11 | 37 | 56 | 35 | 26 | 37 | 41 | 43 | 23 | 26 | ... | 12 | 8 | 7 | 9 | 10 | 194 | 24 | 16 | 16 | 679 |

| additional paid-in capital | 3 | 39 | 65 | 73 | 52 | 48 | 49 | 36 | 18 | 24 | ... | 11 | 8 | 6 | 9 | 8 | 108 | 52 | 10 | 21 | 672 |

| earnings per share | 8 | 56 | 69 | 48 | 53 | 18 | 39 | 33 | 26 | 13 | ... | 5 | 5 | 7 | 6 | 5 | 82 | 52 | 11 | 11 | 564 |

| accumulated deficit | 8 | 24 | 39 | 51 | 38 | 25 | 30 | 28 | 20 | 24 | ... | 8 | 5 | 7 | 5 | 11 | 103 | 50 | 13 | 23 | 543 |

| total assets | 10 | 38 | 38 | 34 | 40 | 43 | 24 | 35 | 20 | 28 | ... | 11 | 14 | 9 | 7 | 9 | 6 | 11 | 11 | 16 | 450 |

| retained earnings | 7 | 62 | 63 | 34 | 41 | 42 | 32 | 17 | 11 | 15 | ... | 5 | 7 | 5 | 6 | 5 | 7 | 6 | 5 | 7 | 404 |

| warrants | 2 | 5 | 23 | 12 | 6 | 6 | 10 | 5 | 3 | 3 | ... | 0 | 0 | 0 | 0 | 1 | 247 | 3 | 4 | 1 | 334 |

| cost of sales | 10 | 26 | 48 | 38 | 31 | 23 | 23 | 16 | 15 | 15 | ... | 12 | 2 | 10 | 2 | 4 | 6 | 3 | 12 | 16 | 333 |

| interest expense | 8 | 43 | 42 | 33 | 38 | 24 | 29 | 17 | 12 | 9 | ... | 7 | 1 | 1 | 4 | 3 | 1 | 2 | 11 | 7 | 309 |

| goodwill | 3 | 27 | 39 | 26 | 19 | 21 | 12 | 26 | 20 | 11 | ... | 9 | 5 | 3 | 5 | 3 | 6 | 6 | 7 | 11 | 272 |

| derivative liabilities | 0 | 0 | 21 | 18 | 11 | 4 | 21 | 10 | 21 | 15 | ... | 6 | 3 | 2 | 4 | 1 | 88 | 6 | 1 | 4 | 259 |

| current liabilities | 11 | 21 | 21 | 21 | 17 | 18 | 11 | 17 | 8 | 16 | ... | 4 | 3 | 5 | 3 | 5 | 7 | 3 | 13 | 7 | 232 |

| accounts receivable | 2 | 18 | 57 | 12 | 19 | 12 | 10 | 15 | 9 | 9 | ... | 6 | 8 | 3 | 7 | 2 | 2 | 5 | 4 | 10 | 226 |

| common stock | 2 | 8 | 27 | 18 | 12 | 13 | 12 | 10 | 6 | 12 | ... | 4 | 7 | 1 | 2 | 4 | 19 | 7 | 3 | 2 | 177 |

| inventory | 3 | 23 | 28 | 20 | 19 | 4 | 11 | 7 | 8 | 1 | ... | 7 | 4 | 7 | 2 | 3 | 1 | 2 | 7 | 7 | 175 |

| income tax expense | 0 | 28 | 22 | 14 | 19 | 10 | 13 | 7 | 2 | 9 | ... | 4 | 5 | 7 | 0 | 2 | 1 | 2 | 9 | 4 | 165 |

20 rows × 22 columns