Float (Outstanding Shares) API in Python

In this tutorial, we will learn how to use Python to retrieve, parse, and analyze float (outstanding shares) data from the Float API that provides information about the share classes, number of outstanding shares, float and reporting period for companies listed on US stock exchanges. This tutorial assumes a basic understanding of Python. We look at two companies with different share class structures, Google and Apple, and visualize the number of outstanding shares over the last 10 years while identifying the impact of share buybacks on the number of outstanding shares.

Click on "Open in Colab" to run the Python code in a Jupyter notebook on Google Colab in your browser.

!pip -q install sec-api

Initialize the FloatApi with your API key so that your requests are automatically authenticated.

from sec_api import FloatApi

import pandas as pd

floatApi = FloatApi('YOUR_API_KEY')

Next, we use the .get_float() method to fetch all historical float data for Google using the ticker search functionality. Looking up float information by CIK is supported as well.

The response of the Float API represents an object with all keys described in the documentation here. For this example, we are interested in the float.oustandingShares list and the reportedAt field.

response = floatApi.get_float(ticker='GOOG') # AAPL

# alternative: use cik lookup

# response = floatApi.get_float(cik='320193')

All historical float information is included in the data list of the response object. pd.json_normalize() helps us converting the JSON data of the response into a pandas DataFrame.

df = pd.json_normalize(response['data'])

# convert reportedAt strings into pandas datetime objects

# to help us to print along the reportedAt time axis

df['reportedAt'] = pd.to_datetime(df['reportedAt'])

df.drop(columns=['id'], inplace=True) # 'tickers', 'cik'

df.head(3)

| tickers | cik | reportedAt | periodOfReport | sourceFilingAccessionNo | float.outstandingShares | float.publicFloat | |

|---|---|---|---|---|---|---|---|

| 0 | [GOOGL, GOOG] | 1652044 | 2023-02-02 21:23:45-05:00 | 2022-12-31 | 0001652044-23-000016 | [{'period': '2023-01-26', 'shareClass': 'Commo... | [{'period': '2022-06-30', 'shareClass': '', 'v... |

| 1 | [GOOGL, GOOG] | 1652044 | 2022-10-25 21:32:59-04:00 | 2022-09-30 | 0001652044-22-000090 | [{'period': '2022-10-18', 'shareClass': 'Commo... | [] |

| 2 | [GOOGL, GOOG] | 1652044 | 2022-07-26 19:29:36-04:00 | 2022-06-30 | 0001652044-22-000071 | [{'period': '2022-07-22', 'shareClass': 'Commo... | [] |

print('Datatypes:')

print('Cells of `float.outstandingShares` column:\t\t', type(df['float.outstandingShares'][0]))

print('Item of a list in a cell of float.outstandingShares:\t', type(df['float.outstandingShares'][0][0]))

Datatypes:

Cells of `float.outstandingShares` column: <class 'list'>

Item of a list in a cell of float.outstandingShares: <class 'dict'>

Note: If you are already familiar with pandas' .explode() function, you can skip ahead to the next section.

As we can see, each cell of the float.outstandingShares column includes a list of three dictionaries instead of single scalars (strings and integers). The reason being is that each cell represents a moment in time where the information about the float of each share class was disclosed. In case of Google's outstanding shares, we deal with three different share classes:

- Common Class A

- Common Class B

- Capital Class C

For that reason, a cell always includes a list with at least one dictionary (representing one share class), while the list can include more than one dictionary if more than one share class is available.

Our goal is to unnest (or explode) each cell so that we can access the period, shareClass and value per shareClass individually via separate columns instead of having to destruct all the dictionaries every time we want to access the information for a specific share class.

In the following step we split the float.outstandingShares column into three new columns, period, shareClass and value (=number of shares outstanding per share class) and unnest all dictnaries per list. The same will be done for the float.publicFloat column so that we end up with six new columns in total. The .explode() method in pandas helps us here.

We split the float.outstandingShares column by creating a new column for each key of the dictionaries. For example, the first cell represents a list of three dictionaries with three key/value pairs:

[

{'period': '2023-01-26', 'shareClass': 'CommonClassA', 'value': 5956000000},

{'period': '2023-01-26', 'shareClass': 'CommonClassB', 'value': 883000000},

{'period': '2023-01-26', 'shareClass': 'CapitalClassC', 'value': 5968000000}

]

With the keys: period, shareClass, value.

First, we run df.explode('float.outstandingShares') to turn a single row into as many new rows as there are dictionaries in the list of the float.outstandingShares cell of the row.

Next, we convert each dictionary per row into a one-dimensional array (series) with three values, each value representing the period, shareClass and value values. The corresponding function is: df['float.outstandingShares'].apply(pd.Series)

The entire conversion is depicted in the figure below.

The first snippet of our df dataframe represents the first two rows of the float.outstandingShares column. Each row includes three dictionaries, each dictionary includes three key/values pairs, highlighted in red, blue and yellow, respectively. After the conversion, the resulting new dataframe has three columns, and six rows. In other words, the first cell of the float.outstandingShares column was split into three new rows and three new columns.

In the final step, we merge the two newly generated dataframes with the original df using pandas' .join() like this: df.join([df2, df3], how='outer').

# float.outstandingShares

df2 = df.explode('float.outstandingShares')['float.outstandingShares'].apply(pd.Series)

df2 = df2.rename(columns={"period": "outstandingShares.period",

"shareClass": "outstandingShares.shareClass",

"value": "outstandingShares.value"})

# float.publicFloat

df3 = df.explode('float.publicFloat')['float.publicFloat'].apply(pd.Series)

df3 = df3.rename(columns={"period": "publicFloat.period",

"shareClass": "publicFloat.shareClass",

"value": "publicFloat.value"})

float_data = df.join([df2, df3], how='outer').drop(columns=['float.outstandingShares', 'float.publicFloat', 'sourceFilingAccessionNo'])

The new DataFrame float_data has six new columns

outstandingShares.periodoutstandingShares.shareClassoutstandingShares.valuepublicFloat.periodpublicFloat.shareClasspublicFloat.value

while all dictionaries of the two columns float.outstandingShares and float.publicFloat were completed unnested into the cells of the six new columns.

float_data.head(5)| tickers | cik | reportedAt | periodOfReport | outstandingShares.period | outstandingShares.shareClass | outstandingShares.value | 0 | publicFloat.period | publicFloat.shareClass | publicFloat.value | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | [GOOGL, GOOG] | 1652044 | 2023-02-02 21:23:45-05:00 | 2022-12-31 | 2023-01-26 | CommonClassA | 5956000000 | NaN | 2022-06-30 | 1.256100e+12 | |

| 0 | [GOOGL, GOOG] | 1652044 | 2023-02-02 21:23:45-05:00 | 2022-12-31 | 2023-01-26 | CommonClassB | 883000000 | NaN | 2022-06-30 | 1.256100e+12 | |

| 0 | [GOOGL, GOOG] | 1652044 | 2023-02-02 21:23:45-05:00 | 2022-12-31 | 2023-01-26 | CapitalClassC | 5968000000 | NaN | 2022-06-30 | 1.256100e+12 | |

| 1 | [GOOGL, GOOG] | 1652044 | 2022-10-25 21:32:59-04:00 | 2022-09-30 | 2022-10-18 | CommonClassA | 5973000000 | NaN | NaN | NaN | NaN |

| 1 | [GOOGL, GOOG] | 1652044 | 2022-10-25 21:32:59-04:00 | 2022-09-30 | 2022-10-18 | CommonClassB | 884000000 | NaN | NaN | NaN | NaN |

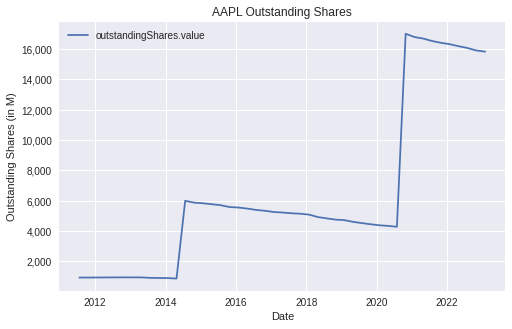

Outstanding shares of Apple from 2012 to 2023

Now let's put everything together and visualize Apple's number of outstanding shares over time from 2012 to 2023. We are able to identify Apple's stock splits in 2014 and 2020 while understanding the impact of Apple's share buybacks over the course of the last decade.

response_aapl = floatApi.get_float(ticker='AAPL')

df_aapl = pd.json_normalize(response_aapl['data'])

df_aapl['reportedAt'] = pd.to_datetime(df_aapl['reportedAt'])

df_aapl.drop(columns=['id', 'tickers', 'cik'], inplace=True)

# float.outstandingShares

df2_aapl = df_aapl.explode('float.outstandingShares')['float.outstandingShares'].apply(pd.Series)

df2_aapl = df2_aapl.rename(columns={

"period": "outstandingShares.period",

"shareClass": "outstandingShares.shareClass",

"value": "outstandingShares.value"})

# float.publicFloat

df3_aapl = df_aapl.explode('float.publicFloat')['float.publicFloat'].apply(pd.Series)

df3_aapl = df3_aapl.rename(columns={

"period": "publicFloat.period",

"shareClass": "publicFloat.shareClass",

"value": "publicFloat.value"})

aapl_float = df_aapl.join([df2_aapl, df3_aapl], how='outer').drop(columns=['float.outstandingShares', 'float.publicFloat', 'sourceFilingAccessionNo'])

import matplotlib

import matplotlib.pyplot as plt

plt.style.use('seaborn')

# y-axis formatter formats "16000000000" to "16,000"

def millions_formatter(x, pos):

return '{:,.0f}'.format(x*1e-6)

ax = aapl_float.plot(y='outstandingShares.value', x='reportedAt')

ax.yaxis.set_major_formatter(matplotlib.ticker.FuncFormatter(millions_formatter))

ax.figure.autofmt_xdate(rotation=0, ha='center')

ax.set_xlabel('Date')

ax.set_ylabel('Outstanding Shares (in M)')

ax.set_title('AAPL Outstanding Shares')

plt.show()